Good morning Micro Investors!

New year, new edition of Micro Caps in 10 minutes. If you are not yet subscribed, you can join the best newsletter for independent investors who are not afraid to invest in the most unknown companies in the market. If you are a colonizer of the micro cap universe, this is your site.

In this new section, which I will publish every 2 Fridays, we will review updates on the companies in the portfolio, news and investment (or non-investment) ideas.

Today in 10 minutes:

1 - Idea: Laser Photonics, laser cleaning systems

2 - Future research: Redishred and Duratec.

Idea: Laser Photonics, laser cleaning systems

Spoiler alert: I have NOT invested in Laser Photonics, read on.

A few weeks ago I came across this tweet:

Being the cheap ass value investor I am, I like businesses that trade at EV 0, and more if the business is half good. I couldn't resist investigating further, and that is how I came to Laser Photonics Corporation (NASDAQ: LASE).

Yes, yes, neither OTC nor any exchange from Eastern Europe, the NASDAQ,

Why will this opportunity exist? Do they make money? Is the business really going to double its sales every year? Could it be that the board steals from the shareholders?

The opportunity: Buy an industrial company with increasing demand and quality at EV close to zero, taking advantage of a special situation of a failed IPO (like so many in '22).

Let’s see.

The company

Laser Photonics is dedicated to manufacturing and selling laser equipment for cleaning, marking and cutting. Of all their products, the best sellers are the portable laser cleaning systems, they are also what the company is focusing its sales and development efforts on, so I am going to focus on those and leave the marking and cutting systems a bit aside.

The concept of laser cleaning can be strange and consists of removing rust, paint or other coatings from parts. It is used mainly for metallic elements, although not exclusively.

Laser cleaning technology is not new, but it has gained popularity in recent years. On the one hand, fiber optic lasers have become more powerful and cheaper, plus they are a much more efficient and compact option than the old CO2 lasers. On the other hand, the cleaning of parts with laser is presented as a safer alternative for the operator to other solutions.

The other two main alternatives are:

The projection of abrasives such as sand (respiratory risks) or dry ice (requires thermal protection due to the risk of freezing).

Anti-rust chemicals, with similar problems to the previous method, due to risk to the operator's health. In addition, its application is complex in large parts or pieces that can be damaged by immersing them in chemicals (a battery, for example).

Another advantage of laser cleaning systems is the operating cost, lasers only use electricity, while other systems use consumables such as abrasives or chemicals. The downside is that, although lasers have come down in price in the last decade, they are still expensive. Pricing for a high powered laser cleaning system typically starts at $50K, with high end systems going up to $500K.

Laser Photonics manufactures portable laser cleaning systems of up to 3kW of power (while developing a 4kW one), they are the most powerful on the market.

Sales and profits

Ok, it seems that selling lasers is a good business, with gross margins of 60-70% and net of 15-20%, without much CAPEX and with growth of 15% in '22 after growing 90% in '21. The business has no debt, and it is foreseeable that it can grow with ROCEs above 20%.

Quality industrial business sign with some sort of barrier to entry, okay.

The laser cleaning market

This study predicts a growth of the laser cleaning market of 4.3% until 2028. It is a moderate growth (and does not seem to fit with the predictions of Laser Photonics of doubling sales every year, which appear in the initial tweet) but there are particularities that can especially benefit Laser Photonics.

In the United States, a major factor that has contributed to significant enhancements in laser cleaning in aerospace is the increased expenditure by the government on the US army. The United States led the ranking of countries with the highest military spending in 2021, with USD 801 billion dedicated to the military.

In January 2021, the US Navy tested laser cleaning technology on aircraft support components to safely remove corrosion and other hazardous coatings. The Fleet Readiness Center East (FRCE), a division in the US Navy, is looking to adopt laser ablation technology at the facility, replacing other traditional methods of cleaning like plastic blasting and mechanical removal methods, both of which use a significant amount of consumables , and can be dangerous to operate.

LASER CLEANING MARKET - GROWTH, TRENDS, COVID-19 IMPACT, AND FORECASTS (2023 - 2028), Mordor Intelligence.

Both the defense department directly and the companies that work for it have a preference for suppliers based in the United States, this is the case of Laser Photonics, and if few of its competitors are also based in the United States, it can be a competitive advantage.

The Competition

The laser cleaning market is quite fragmented. In fact Laser Photonics (with sales under $5M) is one of the top 5 competitors.

USA:

IPG Photonics: Manual system up to 1.5kW. medium power, large offering of custom systems for industrial applications, dedicated to all laser applications in industry and not just cleaning, multi-billion dollar sales.

Adapt Laser: Manual systems up to 1.6kW. They work for the air force. They do not manufacture in the United States, they are a distributor of cleanlaser, a European manufacturer.

Canada:

Laserax: Manual systems up to 100W

EU:

P-laser: Portable systems up to 2kW.

Trumpf: Similar to IPG, they don't develop manual systems, they adapt standard laser systems to cleaning applications. Custom projects, sales of several billion euros.

China:

Jeztech: Manual low power systems, up to 500W.

XT Laser: Manual systems up to 500w

Laser Photonics is one of three manufacturers of laser cleaning systems in the United States and is the manufacturer with the most powerful portable systems on the market.

Add this to a fragmented market, and we can have a decent competitive advantage, where bigger competitors like Laser Photonics are preferred for public and large customer contracts. Having the most powerful systems is differential, because it is the area of the market that is growing the most.

-From Q3 '22 IPG Photonics Conference Call:

Demand for low power pulsed wave lasers (<1KW) down YoY

Demand for high power pulsed wave lasers (>1KW) growing really fast, brilliant results for cleaning applications.

Clients

25% of Laser Photonics are for the North American Department of Defense, the rest is divided among a variety of industries. It strikes me that they have large clients, such as General Electric, 3M or General Motors.

It doesn't look bad when a small company gains the trust of top-tier companies, they must be doing something right.

Why does this opportunity exist?

$LASE went public on September 30, '22, for which they have issued 3M new shares, which they have sold to the IPO promoter at $5 per share. Immediately (ie, the same day they went public) the stock fell to $2.6. Bad business for the promoter (Alexander Capital, LP)

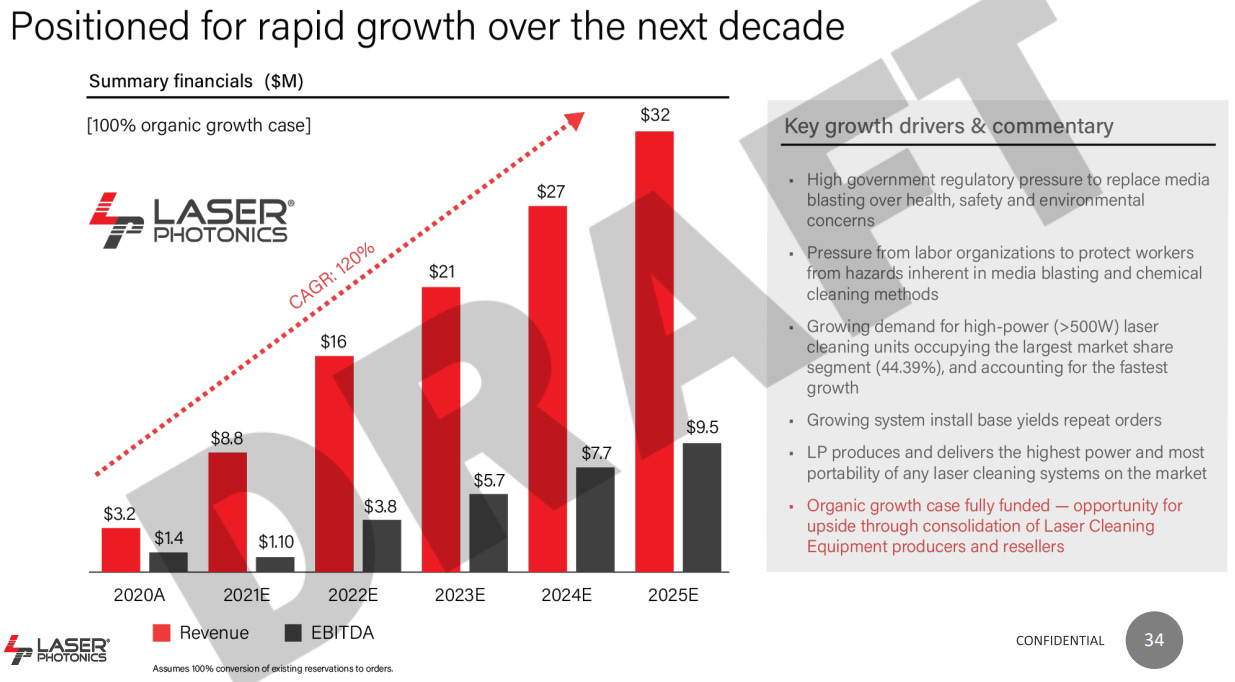

At $5, the capitalization of the company would be $39M, more than 25x EV/EBITDA. That's a demanding multiple, even if we believe the 120% CAGR growth estimate that the board published in '21 (more on red flag #1).

Right now, with the Laser Photonics trading at $2, we can buy the company for $15.7M, if we subtract the $13.2M they have in cash (result of the IPO) we are left with an EV of $2.5M, for a company that will generate $1.2M of EBITDA in '22. Being the quality business that it seems to be, with good growth prospects, we could be in a special situation if it weren't for a few red flags.

Let's go back a bit in the history of Laser Photonics.

In the mid-'20s, when Laser Photonics submits initial paperwork to the SEC to register and subsequently go public, the SEC counters, asking CEO Wayne Tupuola to explain his relationship with Fonon Corporation.

Please disclose when Mr. Tupuola became your president and chairman of the board and describe his business experience during the past five years. For example, it is unclear why your disclosure does not address Fonon Corporation. Please balance your disclosure with information regarding any material delinquent filings of the identified companies, and include any appropriate risk factor. Finally, please revise to briefly disclose the specific experience, qualifications, attributes or skills that led to your conclusion that Mr. Tupuola should serve as a director in light of your business and structure. For guidance, see Item 401(e)(1) of Regulation SK.

-Laser Photonics Corporation Registration Statement on Form 10 Filed April 30, 2020

What is Fonon?

If we search a bit we find a website (www.fonon.com) that no longer works and a few annual reports from '16. Seems that this is not the first time that Laser Photonics is a listed company, it already did so in '15 under the name of its parent company:

Fonon Corporation (OTCMK: FNON).

Fonon was the company that owned the Laser Photonics brand, and was also engaged in laser research. They bought a listed mining company without activity, changed its name and went public on the over-the-counter market.

Its CEO was Dmitry Nikitin. Who we find today as Managing Partner of ICT Investments (owner of 60% of LP). Dmitry founded Fonon in Russia in '92 and Laser Photonics in '02. He is also the director of ICT Investments, and from what it seems one of their only 3 employees. Another is Tanya Nikitina, also a director, who I suspect is her daughter.

Although Dmitry Nikitin is not listed as a direct shareholder in Laser Photonics, he is in ICT Investments, thus controlling the company indirectly, just as he controlled Fonon.

And how did Fonon? Well, in '18 it stopped filing quarterly reports required by the SEC, and in 2019 it stopped being traded. For the shareholders of $FNON, it did not end well. All business under the Laser Photonics has been moved to the company that is listed today, leaving the shareholders who invested in '15 potentially losing everything.

As for the reason for delisting, current CEO Wayne Tupuola reports to the SEC was tax problems resulting from the past activity of the mining company they bought. I don't know more details, nor do I care too much. We undoubtedly find here the:

Red flag #1

The current majority shareholder and founder of the company, Dmitry Nikitin, who controls Laser Photonics through ICT investment already took it public 7 years ago and subsequently stopped reporting to the SEC, making delisting the company, potentially leaving shareholders with nothing.

Financial Shenanigan at its best.

As if this were not enough, there is more. Here we go with some related party transactions.

From the IPO prospectus:

We have an exclusive license agreement with ICT Investments, LLC (“ICT Investments”). Under the terms of the exclusive license agreement, we have a perpetual, worldwide, exclusive license to sell the Laser Photonics™ branded equipment for laser cleaning and rust removal.

How is this license?

Do they pay fees?

Will they pay them in the future?

Under what circumstances could ICT cancel the license?

In addition to this:

Debt of $267,000 with ICT at 6% per year.

Rental of offices to ICT for $180,000 per year.

Dmitry made his daughter Tatiana Nikitina marketing director in '20, although she has already resigned.

These last points do not worry me, but the license does. We are facing:

Red flag #2

The owner and founder of the company licenses the brand through which the company markets 100% of its products, through an unknown agreement.

Let’s go with the third.

Since always, the board has been very prone to promise great results. Already in '15 Fonon promised technology to revolutionize humanity (while selling laser cutters).

In early '21, in its investor presentation, Laser Photonics was forecasting 120% CAGR annual growth. They'll end '22 with some $5M-$6M in sales, far from the $16M forecast.

They also ensure that this organic growth is fully financed, which contrasts with the capital increase made a year later, where they did find use for $13M. This is it:

Red flag #3

Overpromise, underdeliver.

As for insider ownership, apart from the indirect ownership by Dmitry, the CEO has $200.000 in stock, and Dmitry’s daughter $80.000. Dmitry and his daughter are buying ridiculously low amounts of stock ($4000 and $200 respectively), on what it would seem to me as a method of showing up in some “insider buying” screening. That, to me is:

Red flag #4

No insiders buying stock at very cheap multiples.

Conclusion

I think that the business of Laser Photonics has potential. The brand has a presence of several decades in the industry and appears as the main competitor in multiple reports. Finally, manufacturing industrial laser devices has entry barriers and is a quality business.

Yet the company trades cheap for a reason. The board of directors (its founder) seems extremely interested in listing the company despite its small size, the last time they did it the minority shareholder was left with nothing and the record with the regulator is not good (late reports, wrong information provided). The company's publications seem very much aimed at raising the share price by making promises that are then not delivered. The listing cost on the Nasdaq will eat at least half of their current earnings (including $500K/year for a CFO and team).

Now management has $13M in cash and I don't trust them.

I see a perfectly possible scenario that they extract benefits from the company via transactions with ICT, or that they use the company's cash to make it private at a ridiculous price.

I stay out of Laser Photonics, I will follow closely but there are too many red flags at the moment.

Investigación futura

Redishred (KUT): Document shredding services.

Duratec (DUR): Maintenance for mining companies.

If you don’t want to miss out on illiquid and market overlooked companies remember to subscribe to The Micro Investor Newsletter