Good morning Micro Investors!

Welcome to a new edition of Micro Caps in 10 minutes. If you are not yet subscribed, you can join the best newsletter for independent investors who are not afraid to invest in the most unknown companies in the market. If you are a colonizer of the micro cap universe, this is your place.

Tenderhut (WSE:THG) part 2.

This analysis of Tenderhut, a software engineering company that has recently gone public on the main market in Poland is the second and last part. We will see the possible future growth of the company, its business quality (or lack of), management and valuation.

You can find the first part here:

In the first part of this analysis we made it clear that, at least apparently, the multiple at which THG trades once we extract the value of its consolidated non-core businesses is conservative, between 4 and 8 times earnings (depending on which value you assign to these businesses).

In this part we will see if it is justified or indeed an opportunity.

Let's start with growth.

If we want good returns, we either buy very cheap, or we buy businesses that are growing (and if they need little reinvestment, much better).

Growth

Tenderhut sales growth over the last 5 years has been a healthy 37% CAGR. However, since the company has several differentiated segments, it is interesting to review the following.

Growth of each segment:

Contribution by segment to total growth:

What do we get from this?

Well, we have:

1 - Segment of software design, with an organic growth somewhat below 20%, which accelerates to 50% in '22 due to M&A (more on this below). Large effect on overall growth.

2 - The segment of laboratory systems, which except for the year of the pandemic, grows over 20% organically, although it still has a small effect on the total.

3 - Segment of venture building where all the small companies that the group has consolidated on its balance sheet are included.Very volatile and has had a negative effect on growth in '22. The weight of their sales is small compared to those of the group, so if they continue to decrease the effect on the total will cease to be relevant.

Conclusion: Actual core business growth in '22 has been higher than apparent, it is reasonable to expect organic growth in the 15-20% range in the future, plus acquisitions.

Let's see the acquisitions now. It would not be the first case where the benefits of a good deal are wasted on acquisitions that do not generate shareholder value.

Acquisitions

In '21 and '22, Tenderhut has made the following acquisitions, all in the software design segment:

Multiples are attractive, buying businesses in a sector that grows 10% - 15% organically at multiples of 6x profits is not bad at all. You don't need to do any modeling to see how much value is generated.

At a P/E of 6, we have a ROIC of 16% without counting synergies or organic growth from the acquired businesses. Taking this into account, we may be closer to 20%.

Tenderhut has managed to invest PLN 13M, the profits of 2 years, so it is very likely that they will be able to continue reinvesting the cash they generate in the coming years at good rates.

Of the previous acquisitions, the most expensive has been Brainhint (with a 10x earnings multiple) which also seems very reasonable to me if we believe previous growth that Tenderhut management has posted.

Brainhint is a start-up founded in 2017 by Michał Forystek; is a partner of Microsoft, UIPath (South African processes), Oracle and Siemens. The team consists of more than 40 people. Each year, the company grew by an average of more than 250 per cent. Sales revenue in 2021 amounted to approximately PLN 5.1 million. For comparison, the entire TenderHut group generated around PLN 61 million in revenue in 2021.

In all cases, the acquisitions are of the bolt on type, where the parent company enters a new market segment. These acquisitions tend to generate the most value.

I like to see two things:

The company has issued shares for at least PLN 60, prices 50% higher than current prices, so far the board seems to have good capital allocation discipline, they would have to find deals at very attractive multiples to justify diluting shareholders at current prices.

From '22 they began to use cash in acquisitions, at least in part. I would like to see this percentage of cash grow.

Conclusion: Tenderhut has a history of making acquisitions, in fact, of the 48% they grew on '22, 25% comes from acquisitions.

Employee cost

Software development and integration companies have a cost that dwarfs all others: the cost of personnel. This cost comes in salaries, benefits for its employees and the cost of subcontracted services (from other companies or freelancers).

In general, these costs vary between 70% and 90% of sales. If they are close to 70% the company has very good margins and ROIC, if they are close to 90% they do not make money.

Let's look at a simple Tier II analysis:

The years in which Tenderhut has generated the best returns have been in which its employee costs have been closer to 70%. In '21 the company managed to maintain more or less constant its employee costs as a % of sales (taking into account the approximation that I am making with the venture building costs). In '22 they have gone up but nothing crazy considering the acquisitions.

This, taking into account salary inflation in Poland, gives us a clue that the company has the capacity to raise prices. Let's see, for example, what happened to another one that I also have in my portfolio, Makolab (WSE: MLB).

Salaries were up very close to 90% of sales in '21.

Good point for Tenderhut.

In addition to this, the percentage of outsourced services is large compared to other competitors with higher scale, this is common in small companies because they have income variability and it is more difficult to relocate employees between projects when you have 100 than when you have 10,000. As this percentage goes down, it is reasonable to expect margins to go up.

ROIC

Typically software engineering and integrator companies are fairly light on capital and have ROICs in the 30-40% range excluding acquisitions. Since they have no way to grow at these rates organically, it is common for them to drop this ROIC by up to 20% including acquisitions (goodwill on the balance).

Tenderhut is no exception:

Conclusion: The main business is quality, like other larger-scale businesses (Nagarro, EPAM) and if it proves capable of reinvesting profits at ROICs like the current ones for several more years, it is very possible that it will trade at the same multiples.

Management

Robert Strzelecki and Waldemar Birk founded Codearch in 2010, which was later sold to the SMT Software group. Robert served as CEO of Codearch during the period of '10 - '14.

In '14 the founders bought the company from SMT Software, renamed it Tenderhut and have since scaled it from PLN 6.5M in sales to PLN 77M.

Following Waldemar Birk's death in '18, Robert serves as CEO of Tenderhut, while Waldemar's son Thomas Brik serves as a member of the board of directors.

Both Robert Strzelecki and Thomas Birk have several decades of experience in the IT sector. Robert and the Birk family have 73% of the outstanding shares and they have not sold shares since the Tenderhut IPO. There are also no compensation programs with shares or programmers or managers that dilute the shareholder excessively, the shares that have been issued have been for acquisitions.

Conclusion:The board of directors has experience in the sector for several decades, they are aligned and have demonstrated a good capacity for allocating capital.

Valuation

Quick valuation

Businesses in the Tenderhut sector are trading at multiples greater than 20.

P/E:

Nagarro - 22

Spyrosoft - 26

EPAM - 29

If we assume a multiple of 18 over the NOPAT of the main business in '22 and add the PLN 45M of the venture building branch, we have a value per share of 86 PLN.

Why 18? Well, less size and liquidity. Could be 16 or 20, the result wouldn’t be so different.

We can assume that the venture building branch is only worth half its last valuation, and we're left with a valuation of 75 PLN per share.

Scenarios in 5 years

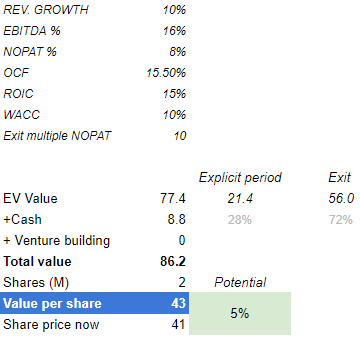

Modeling DCF up to '27, we would have a valuation of 82 PLN per share with the following assumptions.

The company continues to grow 15% at a ROIC of 20% and we assign an exit multiple of just 12x earnings. Side businesses are worth 22.5M PLN. Very conservative, where they reinvest with the same ROIC as they do now with M&A, but grow at a much lower rate.

In a case where everything goes well. They get a 20% annual growth with 20% ROIC, output multiple of 18.

Reverse valuation, what conditions would justify the current valuation?

Assume 10% growth through '27, a drop in net margin to 8% and then a multiple of 10x earnings.

Oh, and- 0 value for the venture building.

This scenario would mean a clear degradation of the sector in the long term, where in '27 the sector is expected to stop growing. In addition to a brutal destruction of the board by investing in various businesses that are worth zero.

Points to monitor: Degradation of margins, more expensive acquisitions, less growth and an increase in working capital above the increase in profits, if this happens we could be facing the latter case.

My final take

I’m long Tenderhut, is a high quality company trading at less than half the size of comparable companies of bigger size but same ROIC and growth. The management has proven to be a good capital allocator (for organic growth at the moment, M&A to be confirmed), has long experience in the industry and skin in the game. The sector is growing at almost 20% a year.

I would like to thank again the following twitter user, from whom I’ve got the THG idea: https://twitter.com/safe_our_souls

Totally worth it to follow if interested in polish stocks.

And that’s a wrap for today! Hope you enjoyed.

See you in the next edition of Micro Caps in 10 minutes.

Dani