Good morning Micro Investors!

New year, new edition of Micro Caps in 10 minutes. If you are not yet subscribed, you can join the best newsletter for independent investors who are not afraid to invest in the most unknown companies in the market. If you are a colonizer of the micro cap universe, this is your place.

Today in 10 minutes:

1 - The Micro Investor portfolio. January 2023

2 - Avante Logixx (TSVX:XX) buys C&B Alarms.

3 - HAV Group (OSL:HAV) gets multiple contracts.

Sometimes I get the impression that on Twitter every time the stock market goes up everyone is invested, and every time the stock market goes down everyone is liquid.

It is very easy to share hundreds of ideas in which you do not invest yourself (or invest a very small amount of your portfolio) and then promote the successful ones and forget about the failures.

We also have the twitter bios like “30% CAGR last 7 years”. Without doubting anyone:

It is not the same:

“I have invested for 7 years in a portfolio of 20 microcaps and I have achieved a 30% CAGR”

that

"I bought Gamestop in 2016 and I did a 6x in 2021”

Both are 30% annualized, but hey, you know what I mean.

That is why I have decided to adopt the philosophy of building in public Every month I will publish:

Updated portfolio: all positions with their weights.

Purchases and sales during the month: including the average price and the weight of the total portfolio.

Evolution: my portfolio is denominated in

millions ofeuros and the evolution will include currency effects. I will adjust the value in January 2023 to 100, and the evolution from this point will be similar to that of an investment fund,the effect of withdrawals or deposits will not be taken into account.

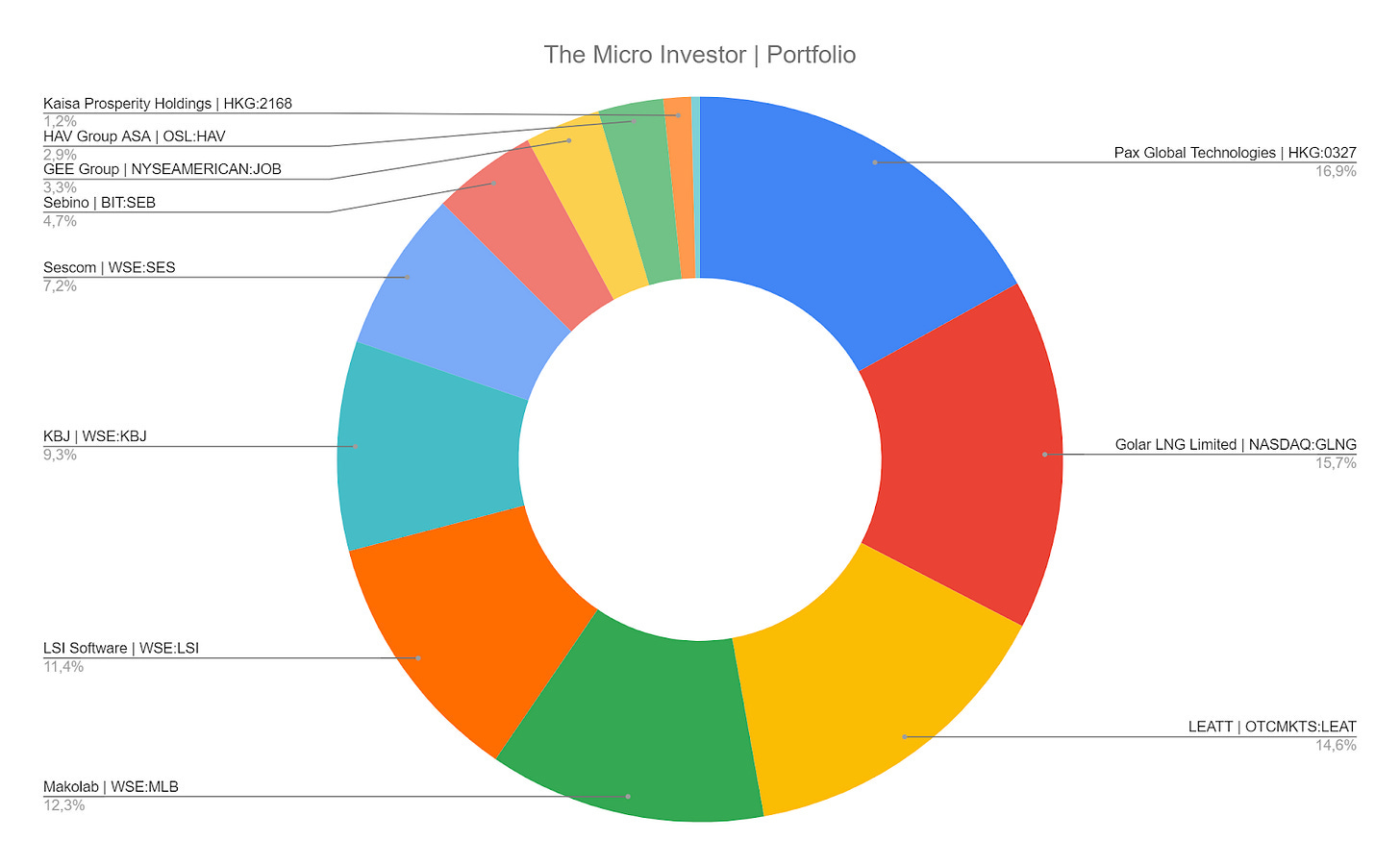

Portfolio in January 2023

Positions:

Purchases:

Sales:

None

A Note on Diversification

I am aware that my portfolio is very concentrated, the first 5 positions represent 70%. My intention is to reduce this concentration as I find new investment ideas that are worth competing with the biggest holdings, but I will follow a philosophy of not giving up upside potential to reduce volatility. Possibly this will result in holding 10-15 companies, with positions of 5%-15%.

On the shoulders of giants

Some of the holdings in the portfolio are proprietary discoveries, such as KBJ or Sescom. Others are not original ideas but I have done my own analysis from scratch before investing, such as Makolab, LSI Software (ideas from https://twitter.com/HolyFinance) or LEATT (https://twitter.com/TheLazyBeavers).

However, some of my biggest positions are formed from the work of other members of the Twitter investment community, they are what I considergiants in which I have enough confidence to park important parts of my money.

Two of these positions, new to the newsletter are:

Pax Global

Idea by Gabriel Castro (manager at Singular Asset Management):

One of the leading manufacturers of payment devicesVAT of the world, growth of more than 20% per year and issuingprofit warnings every quarter. It trades at an EV/EBIT of 3.

In addition to all Gabriel Castro's tweets, a very complete thesis of:

I can't think of many investment ideas with such an easy path to 25% CAGR returns, with the protection of having half the market capitalization in cash.

Golar LNG

Another from Gabriel Castro:

Complete thesis here:

https://seekingalpha.com/article/4549871-growth-is-around-the-corner-for-golar-lng

One of the few companies in the world that manufactures LNG gasification vessels and the only one that has had one running without problems for years, manufacturing another. Boats are built to order and leased on 20-25 year contracts, providing maximum revenue visibility. It trades at 8x EBITDA, which protects us from downside, theupside it comes from the high probability that they will sell 1-3 more ships in '23, which would double their value.

GEE Group

Idea of (https://twitter.com/Investmentideen):

Complete thesis here:

Temporary work services company andheadhunting in the United States, trading at record lows after a capital increase resulting from excessive indebtedness. Now it has no debt, has some hidden assets and is trading at P/E 5.5x. Stable business that is only affected by crises in case unemployment reaches high rates.

Avante Logixx buys C & B alarms.

Next Logixx (TSXV:XX) has purchased an alarm business in Canada's Muskoka region, where it already has a presence.

This is very good news for the company, it is a very small acquisition, $0.6M vs. the $10M they have in cash, but it shows management's ability (and intention) to use that cash, the path to operating leverage.

The shares are up 35%, although with the liquidity that exists they could return to the previous point at any time.

More aboutNext Logixx here:

HAV Group wins several contracts

HAV Group (OSL:HAV), the company for efficient ship design, electric propulsion systems and seawater disinfection, has won several contracts. Good news, the stock fell last quarter after the drop in pending orders.

Contracts withVolstad Maritime from January 3 and December 14.

Contract with CREST on January 17, for an offshore service vessel in the United States.

And that’s all for today!

Thanks for reading and don’t hesitate to reach me out here or on twitter.

Dani