Leatt. The Science of Thrill

Protective gear retailer, at compelling valuation, capitalizing on decade long brand and reputation.

Leatt (OTCMKTS: LEAT) is engaged in the sale of protective equipment for off road cycling and motorcycling. It has been selling neck protectors for nearly two decades, and is now capitalizing on its reputation in the industry to expand into other product lines.

Disclaimer: Do your own research. The author of this post has a position in this company, which is also illiquid.

1. Key points

Growth 2016-2021 of 33% CAGR.

88% growth in Q1 '22

Operating leverage, margins grow with sales.

ROIC of >50%.

No debt

Insiders own 36% of the company.

It trades at a P/E LTM of 8.9 and an estimated P/E of 2022 of 7.

Expected return: 40% CAGR in 4 years.

Catalyst: Maintenance of previous growth. Increased margins. Re-rating due to increase in size, listing on Nasdaq.

Opportunity to buy a company run by its founder, who has been developing protection products for offroad cycling for several decades. Business in a sector with tailwinds, which steals market share by trading at multiples that imply zero growth in the future.

2. Why does this opportunity exist?

Micro cap of $120M in the OTC market.

Little followed by analysts.

Little liquidity, $20,000 - $80,000 a day.

Contraction of multiples due to the end of the pandemic effect, which has benefited companies in the outdoor sports sector. This effect is not shown in the fundamentals of Leatt, which continues to grow and steal market share.

3. Risks

Loss of brand perception: If Leatt does not continue to innovate, its brand image can be degraded, possibly causing a reduction in margins.

Supply chain issues: Leatt manufactures in China, future supply chain issues like the ones you've had could impact us.

Reduction of gross margins: Leatt has its own distribution in the US, however it works with distributors in other markets, which causes it to have lower margins. Leatt can improve this situation by increasing its distribution capacity in these markets and selling directly to the consumer on its website.

Studies that invalidate a Leatt patent: If any study calls into question the effectiveness of neck protection systems or the Turbine 360º helmets, Leatt's brand image could be worsened.

Loss of alignment between Leatt directors and shareholders: Current high director compensation, $700k/year in Dr. Leatt's case, still small relative to his shares.

Leat is dedicated to the sale of protection elements for off road cycling and motorcycling. It is a simple business with no barriers to entry in terms of certifications or production, however it does have an element of customer trust as a barrier to entry.

Nobody chooses an unknown helmet brand to save 15%. And less the type of habitual user who buys Leatt products, which we will see during this Thesis, has the money and the desire to spend on his hobby.

In spite of having a few competitors (there are some, with small market shares and more or less niche products), price is not the first differentiating element that the customer notices.

This, together with the current valuation of the company, means that it is hardly necessary to assume future growth for our investment to give us a more than acceptable return. And the growth is there.

4. What does the company do?

Leatt is a "Head to Toe''. It is a term that I had not heard until I started researching the company. Unlike other competitors, Leatt has in its range of products all the necessary elements so that you can do Mountain Biking or Offroad Motorcycling safely.

Leatt is an innovative company, its products have had a long history of awards:

Neck protectors:

This is not, as of today, the best-selling Leatt product. However, they are what gave rise to the company. They serve to protect the neck from extreme movements.

In a fall, they limit the range of motion of the neck, reducing serious cervical injuries.

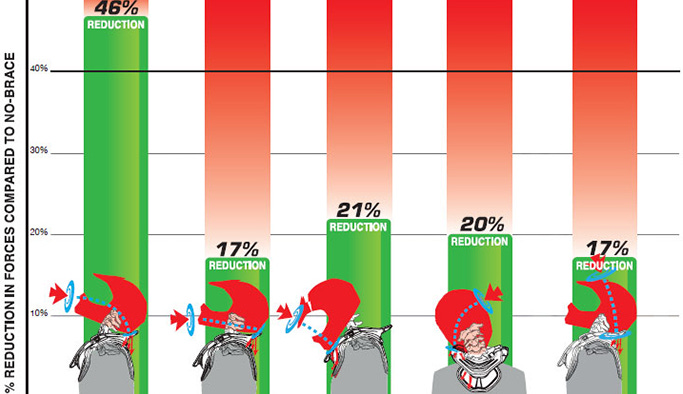

The effectiveness of this element is not proven in a large number of scientific studies, the most extensive being a semi-empirical study conducted by EMS Action Sports. EMS is an ambulance service specialized in action sports such as motocross. The study found clear effectiveness of neck protectors and is cited by Leatt herself on her product pages.

EMS Action Sports: https://www.actionsportsems.com/case-study-neck-brace

However, the EMS study is not formal and is not published in any peer reviewed journal. That is, we cannot consider it reliable evidence. Leatt has done its own studies, which use a more scientific methodology, but it has not been published in any peer-reviewed journal either, so we have to take them with care:

Leatt's own study: https://leatt-cms-image.s3.amazonaws .com/2.3.4+White+Paper.pdf

As a positive point towards the effectiveness of these systems, neck protectors are also used in Formula 1, where the HANS system performs a similar function.

On the other hand, although Leatt has the majority of the market share in these systems, other well-known brands such as Alpinestars have also developed them, which makes me confident in their effectiveness.

Conclusion: Neck protector effectiveness data is subject to change and is a risk, more than for Leatt's sales (protectors no longer represent such a significant part of sales) for its credibility. Some independent studies are good, and others find no evidence of injury reduction (they don't deny it either, they just can't confirm it with the methodology used). The largest study conducted, although it finds clear evidence of effectiveness, is based on anecdotal evidence and does not meet the standards of scientific publications. On the other hand, if this effectiveness is confirmed by other independent studies, the use of neck protectors could be extended. I do not see it likely that the effectiveness of this type of protectors will be invalidated due to:

Leatt is not the only brand that markets them, other recognized brands have developed them.

Similar systems are used in other extreme sports.

Helmets:

Leatt helmets differ from other helmets on the market because of a proprietary technology they use, the "Turbine 360º". Flexible elements inside the helmet allow the head to rotate relative to the outside. In addition to absorbing linear impacts, side impacts that generate head rotation are absorbed.

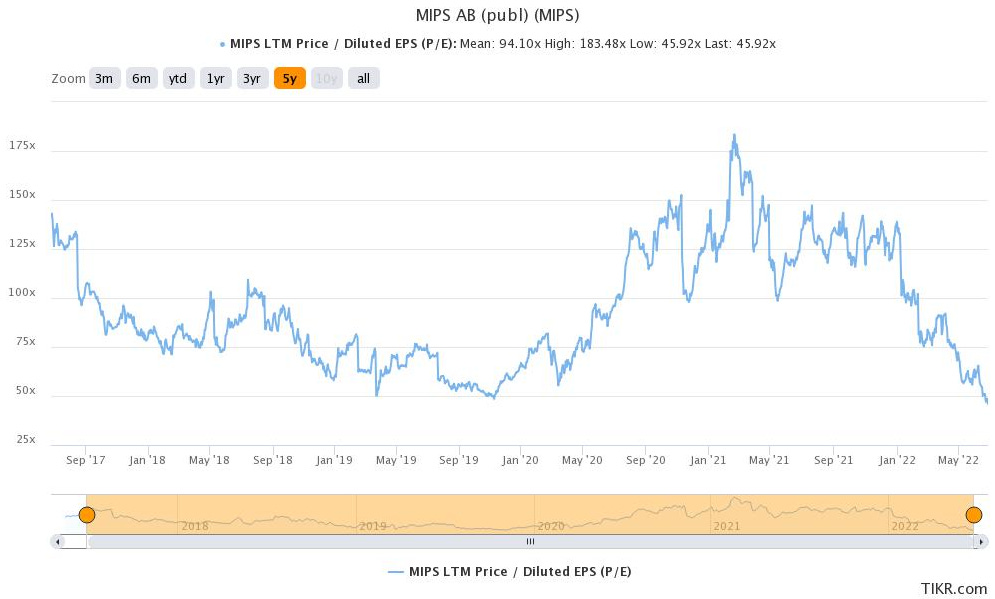

Is this technology something revolutionary? Not necessarily. There is already another technology on the market that does something similar, from the Swedish company MIPS.

MIPS does not manufacture helmets, but instead licenses its patent to other manufacturers (in fact, to most major manufacturers). Leatt has decided not to use MIPS, so it does not depend on a third party, nor does it have to pay royalties. I have not found any study that compares the two technologies, so a priori both do the same thing. According to Leatt herself, Turbine 360ª technology, unlike MIPS, also absorbs linear impacts.

MIPS and Turbine 360º are not the only technologies on the market, there are other brands that develop their own solutions, although less well known. They seem like different ways to get to the same result. All are, at least, valid since the helmets have to pass the same certifications (ASTM F1952 in the case of bicycle helmets and ECE 22.06 in the case of motorcycle helmets).

More information about the Turbine 360º technology in the Leatt white paper: https://b2b.leatt.com/amfile/file/download/file/1024/

The acceptance of this technology is yet to be proven, but if it is a competitor for MIPS, Leatt could license it in the future.

Body protection:

Since 2010, when they started manufacturing the first body protectors, Leatt's offer has been expanding. Chest, legs, elbows, knees, shoes, wrists. They have a complete offering of equipment for the whole body.

Others:

Glasses and clothing for both bicycle and off road motorcycling. Little by little they are representing a significant percentage of sales. They are a good indicator of the brand image, since the brand is a key factor when buying these elements that do not provide extra security.

5. Leatt Story

The story of Leatt begins in 2001 when Dr. Leatt witnessed an MTB accident resulting in the death of one of his friends due to a cervical injury. At that moment he decides to design a neck protector to avoid this type of injury.

They sell the first protector in 2004, and the company becomes a leader for this niche product. It is not until 2011 that they begin to develop other products.

Although Leatt is a small competitor in the market for most of the products it sells (we will see market shares in a bit), it must be taken into account that it has been in the market since 2004. It has had time to generate an image of respected brand in the community.

6. The market

Regarding the market in which Leatt operates, we can ask ourselves a couple of questions. On the one hand, how much will the market in which Leatt works grow or decrease? And on the other hand, how much does Leatt already have in that market?

Organic growth

I have found several studies that analyze the growth of the protection market for Mountain Bike as well as for offroad motorcycling.

This study forecasts Tech Navio a 4.6% CAGR growth for the MTB gear market through 2026. This is in line with this study Grand View Research which forecasts a 4.6% growth for the overall cycling gear market . The growth of the motorcycling protection market (not offroad, in general) is forecast at 6.4% in this study, also from Grand View Research.

Conclusion: The available studies are conclusive in that a growth of 4%-6% is expected in the markets in which Leatt operates. We are facing a situation with light tailwinds.

Leatt's market share

Leatt is the market share leader in one product, the neck brace. In the rest of the products, its market share is relatively small. Let's go by parts:

Offroad motorcycling. Study: 2021 Racer X Readers' Choice Survey

Neck Protector: 52%.

Helmets: 2.7%.

Boots: 1.6%.

Sweaters: 1.3%.

Pants: 1.1%.

Gloves: 2.3%.

Glasses: 3%.

Chest protector: 15.8%

Mountain Bike. Study: Pinkbike annual survey 2021. This study is interesting because it asks respondents not only what brand they currently own, but also which one they plan to buy.

These data fit with another independent study. 2021 South African Mountain Biking Survey, by Garmin.

Conclusion: Leatt has a high share of the neck protector market, where it has been a leader for years. The rest of the company's products, which represent 82% of sales in 2021, have small market shares, in the range of 1% - 5%. Not only this, but those market shares are increasing at high rates. Leatt is stealing market share, which is certainly a good sign.

Who buys?

The above studies also give us a view of the average Leatt customer, and of the MTB and offroad motorcycle protection market.

Offroad motorcycling. 2021 Racer X Readers' Choice Survey

Mountain Bike. Pinkbike annual survey 2021

Conclusion: The public that buys this type of protection has a high purchasing power, spends several thousand dollars a year on bikes or motorcycles and has been practicing these sports for many years. We are not before a beginner public.

Price sensitivity will be less relative to other factors, such as brand reputation or perceived quality of protections. The customer has the money to spend, and wants to spend it on their hobby, the difference between a $200 or $300 helmet may not be the key point in their purchase decision.

7. Sales and benefits

A picture is worth a thousand words.

Growth

Leatt has had a very high growth in the last 5 years. This growth has greatly accelerated as they have introduced products, versus their original offering of neck protectors, which makes me think they are capitalizing on a brand image built over many years. Many customers may not have been ready to buy a neck brace as it is quite extreme protection, but they were aware of the brand and had a good opinion of it.

Leatt grew in the range of 20%-30% from 2017 to 2020, and then 88% in 2021. Covid has obviously helped, like many other companies that rely on outdoor activities. In fact, this is where one of the bearish arguments against this company comes from, which is considered a beneficiary of the pandemic, and which will return to previous sales once the fury passes. I believe that this is not reasonable, due to the following points:

The purchase intention, which we have seen in the previous point, indicates that Leatt is a demanded brand, it is not at the bottom of the sector.

The growth of outdoor activities is expected to continue.

Leatt continues to grow in 2022, in Q1 they have registered a sales growth of 88%, the pandemic is over.

Leatt's client, as we have seen, is not the amateur who starts doing MTB during covid, they are clients who have been practicing the sport for several years (sometimes decades). The pandemic may have made them practice and spend more on their hobby, but these customers are not going away.

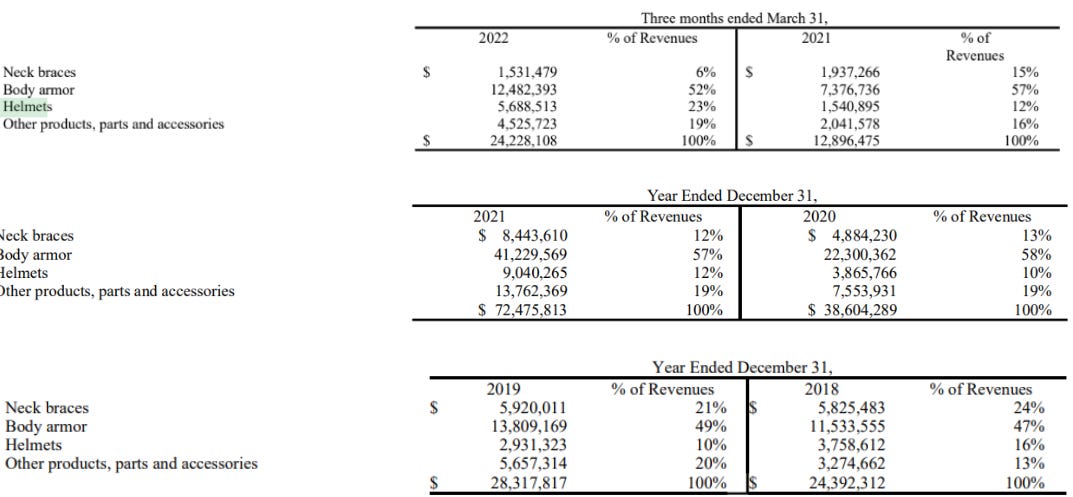

Sales mix

Neck protectors are a residual part of sales today (6% in 2022 Q1). Not because their sales have decreased, which they haven't, but they remain constant. This makes sense since it is a niche product and we have already seen that in MTB they have 75% of the market share and in Moto 52%. Growth will be limited.

They are a residual part of sales because the growth of the other products has been enormous:

Sales of helmets, for example, have grown 269% in Q1 '22 compared to Q1 '21.

Profit Margins

I'm not going to waste a lot of time trying to predict future margin growth. But looking at Leatt's margins we see two things.

Gross margin has deteriorated. The CEO explained it in the last conference call, neck protectors have a higher gross profit margin, so by reducing their weight, this is affected. We should not see further degradation because protectors are 6% of sales. In addition to this, Leatt in the US uses its own distribution, while in other markets it uses external distributors, in these sectors it has a worse margin. Leatt has an opportunity to improve margins in the future by increasing its own distribution network (in Europe, for example) and selling directly to the consumer online.

Net profit has increased. Fixed expenses are diluted. Neither R&D nor other overhead costs have scaled with sales. In 2021, the net margin was 17.5% and the gross margin was just over 40%. I think it is possible that Leatt reaches a 20% net margin but I will not assume a higher increase because it is really difficult to predict if they are going to have to spend more on marketing to increase sales.

8. Board of Directors

Dr. Chris Leatt, the company's founder, is Chairman and Director of R&D. He has 36% of the company, about $43M.

Sean Mcdonald, the CEO, President and CFO has been with Leatt since 2010. He has more than a decade of experience in companies in the sports sector. He has 5% of the company, about $6M.

Compensation for both the CEO and Dr. Chris Leatt is relatively high:

On the other hand, Dr. Chris Leatt has reported his intention to sell 200,000 shares this year. 10% of its shares.

Several managers have a good amount of unexecuted stock options, which reinforces their confidence that the stock will rise in the long term:

Despite the abundant remuneration of the management team, I believe that they are key to the development of the company. Dr. Chris Leatt founded the company nearly 20 years ago after witnessing a fatal cycling accident, and remains at the helm of the R&D team, which has proven capable of innovating across multiple product lines, stealing market share from many other brands. established. We can learn more about the history of Leatt in this interview with its founder:

Shaun Simpson, Dr Chris Leatt + Adam Wheeler Interview

Conclusion: Leatt directors are aligned with the company, its founder has more than 50 times his annual compensation in shares , and its CEO more than 9 times. The CEO receives much of his salary in stock that he is not selling. Compensation is high but reasonable considering the growth that the company has had, it is a point to review in the future.

9. Valuation

Share Price: $21.1

Market Cap: $122M

Enterprise Value: $120M

P/E (LTM): 8.9

Leatt trades at 8.9 times earnings of the last twelve months. The company has grown 80% in Q1 '22. This listing would make sense for a low or no growth business with mediocre and cyclical ROCE, but I don't think it makes sense for Leatt.

Take for example Escalade Incorporated ($ESCA), an outdoor sports retailer. A $172M market, similar to Leatt. earnings, in the Leatt range. However, $ESCA is a business that has not grown from 2008 to 2019. It has benefited from covid with a growth of 50%, and has a ROCE of 15% and margins of 8%.

This is what I mean, Leatt trades at retail multiples with no growth.

Now we are going to look at MIPS, the company that designs and licenses the helmet protection system we talked about earlier. $1.2B Market Cap, no debt, 50% ROCE and 40% margins. It has grown in recent years in the range of 30%-50%. It's an even more similar business to Leatt (I think a little better, actually) and they work in the same market. It trades at 46 times benefits.

I'm not going to rate Leatt like MIPS, it's a smaller company, with less margin and may not be able to sustain as much growth as it has up to now. As Leatt gains market share its growth will slow. I will assume future growth until 2025 of between 10% and 20% and that it is capable of maintaining the profit margin and the current ROCE.

For 10% I will assume a P/E of 12 and for 30% a P/E of 17 (not counting future cash). They seem more than reasonable to me.

Leatt, in fact, has already traded at these multiples not so long ago:

Sale of Fox Racing

As I write this article, a relevant transaction in the sector has been announced. Fox Racing, one of the major players in offroad cycling and motorcycling protection and a competitor of Leatt, has been sold. The buyer has paid $540M, about 10 times EBITDA for the business that generated $55M EBITDA in '21.

Using Leatt's EBITDA and net margins, this transaction would result in a P/E multiple of 14, in line with the range I was assuming in the previous point.

But there is something that stands out to me, Fox Racing, taking into account the 20% growth between '19 and '21 that they point out in the announcement of the transaction, sold about $240M in '19. This is the exact same thing he sold in '14, when he got it from his current dealer.

This confirms what we have already seen in this thesis, that Fox Racing is losing market share in many of its products. It indicates that Leatt is a better business and if it continues to grow its valuation should be higher.

Scenarios

Next we go with the valuation scenarios for '25. As always there are three scenarios, from pessimistic to optimistic.

Growth: 10% - 20% - 30%.

Net margin: 15% - 17% - 17%.

P/E multiple: 12 - 15 - 17 (discounting future cash).

See you on next research!

Dani

Hi Dani, interesting company for sure but think that we need to think more about whether they are really building a brand and I believe that's quite difficult for me to determine since I am not a motorcycler. I don't know whether you have any method to get a good idea about its brand development?

Second, can't find something that indicates that Leatt's products are really better than that of competitors. Whereas I do like the fact that the company tries to be innovative, they don't seem to have developed an edge yet in my opinion.

Lastly, do you have any idea how they have been able to see such a huge increase in revenue in 2021? Covid might have helped but nearly a double in revenue seems like there needs to be something else going on. They are still growing strongly until 3Q22 and am curious how this growth will develop but am not able to forecast something with any comfort.