Micro cap: Makolab. IT engineering at P/E 8 (150% upside)

High potential with margin recovery but client concentration

Note: This post was written on Nov. 2021. Shares have since then declined from 5.85PLN to 4.6PLN making the potential, in my opinion, bigger.

Makolab SA (WSE:MLB) is an IT consulting company, providing services to a client base concentrated primarily in the automotive industry.

1 . Key points.

Growth until 2019 above 20%. During the pandemic greater than 10%.

ROIC of 40%.

30% of market cap in net cash.

Without debt.

Insiders lined up.

Trading absurdly cheap, at 8x 2019 normalized P/E and 4.5x EV/EBIT.

Expected return: 40% CAGR over 4 years.

Catalyst: Recovery of pre-covid margins. Re-rating due to size increase.

Opportunity to enter a quality company with an easy path to compound at 40% CAGR on our long-term investment. Protected by the low valuation and 30% of the price in net cash.

1.1. Why does this opportunity exist?

€9M Nano Cap, with 60% of the shares controlled by the founder.

Very illiquid, only €5,000 per day. Only suitable for private investors.

Not followed by analysts or publicized. Periodic reports in Polish.

Contraction of margins in 2021, caused by wage inflation in Poland, delay until 2022 in raising prices to customers.

Temporary slowdown in growth due to the pandemic.

1.2. Risks

Concentration of clients, loss of some important client could lead to a significant drop in sales.

Inability to raise prices and recover margins.

Slowdown in growth due to increased competition.

2. What does the company do?

Makolab SA is an IT services company that offers software development and consulting to its clients. These services include development of applications such as CRM, CEM, other applications and custom systems.

Its main clients are in the automotive industry.

Its clients are first-tier companies, such as manufacturers or OEMs. They work mainly for the Renault-Nissan group and Toyota. This has a couple of positive points:

The company is probably integrated with the systems and working methods of its customers, with whom it has long-standing relationships, so they would incur costs of switching suppliers. This can provide price increase capacity.

Given its small size, the company can take advantage of automakers' increased spending on digitization and connected vehicles.

The negative point is that this concentration could very negatively affect the company in case of losing a client. Although the company does not publish data on the concentration of sales by customers or sectors, I suspect that a very high percentage of its sales come from the Renault-Nissan alliance.

2.1. Growth Strategy

Is Makolab doing anything to protect itself from this possibility? They are working on these strategies:

Geographic and customer diversification. In August 2020 they create Makolab DE, to capture sales from the region of Germany, Austria and Switzerland. Presumably from German brand automotive manufacturers and suppliers.

Separation of consulting services in the subsidiary Makolab Consulting. In December 2020, they created this entity to develop sales of consulting services. Makolab owns 60% of the shares, (the remaining 40% in the possession of a member of the board, Robert Sendack).

Blockchain projects.

GraphChain (http://graphchain.io/). It is difficult to calculate how much business this project could provide in the future, but they have received grants from the EU (PLN 290,000 in 2020). Growing sector in which they are developing know-how.

LEI.INFO (https://lei.info/). Through the subsidiary Makolab USA they provide registration and maintenance services for LEI identification numbers (https://en.wikipedia.org/wiki/Legal_Entity_Identifier). LEI is a global identification protocol for companies and entities. Makolab brings blockchain verification to this identification.

These projects do not currently provide relevant income to the company, so no growth is projected for these segments. However, they are innovative projects and can attract new clients to the company, helping it to diversify.

The founder is very focused on blockchain projects (Makolab USA has grown by 37% in 2020, from PLN 500k to PLN 705k) and has more than 20 years of experience in the industry. It is reasonable to trust their judgment (more in the directive section).

2.2. Pandemic and wage inflation

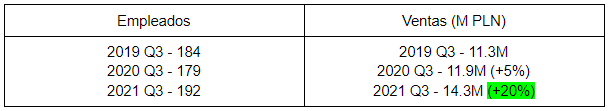

The company has grown in the range of 20%-30% from 2016 to 2019:

At the same time, it has managed to scale its operating margins to 15% and its net margin to 11%.

In the years 2020 and 2021 the company suffers from 2 external problems that hamper growth and profits. These problems are temporary:

The pandemic slows growth. Its clients stop many projects, especially related to the connected vehicle. The previous volume has already been recovered. It is back to 20% YoY growth in 2021 Q3.

Projects could be frozen again in the event of new mobility restrictions in Europe, but lost demand returns quickly. This is a good indicator of future growth.

Wage inflation. In 2021 there is widespread wage inflation throughout Europe and the US. It especially affects the IT sector. Makolab raises wages and goes from spending 79% of income on personnel (2019) to 90% (2021).

The increase in wages causes a contraction in margins. Going from an EBIT margin of 14% in 2019 to lows of 2% in 2021 Q2. This contraction causes a 40% drop in the share price.

The recovery of the previous margins is a fundamental part of the investment thesis, since it will act as a catalyst.

2.3. Recovery of margins in 2023

Why do I think that the drop in margins is temporary?

Widespread salary inflation in the IT sector. Larger competitors like Nagarro are suffering from the same problem. Costs have risen more than income, causing a contraction of margins. Customers will bear higher costs regardless of their provider.

Nagarro Q2 2021

Nagarro herself indicates that demand is strong and that it is normal for price increases to be several months behind costs.

Nagarro Q2 2021

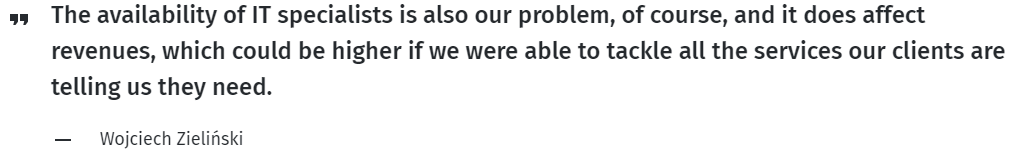

Demand for services. The digitization process of car manufacturers has been restarted at the end of confinement. Even with the limitations that remain in Europe, in 2021 Q3 Makolab has increased sales by 20% YoY, these are very good results. The company itself indicates that the offer of professionals is the limitation to increase sales.

Cost competitive company. If we analyze the cost of personnel, we can get an idea of how competitive a company is in this sector. In the end, the client is usually billed by the hour and usually spends around 80% of sales on personnel. Makolab is lower in costs than competitors, both Polish and international.

Expenditure per person:

Makolab: €27,000 / year (2021, €3.8M in Q3, 192 employees)

PGS Software: €31,000 / year (2020 €7.7M, 249 employees)

Nagarro: €31,000 / year (2020 , €270 M, 8,666 employees)

3. Board

Mirosław Sopek - Founder, Vice President of Makolab and CEO of Makolab USA. He and his wife control 70% of the shares, salary €50k. Experience of more than 20 years in the industry. Very technical profile, involved in other projects related to blockchain (Quantum Blockchain, LEI.INFO, Chemical Semantics…)

Wojciech Zielinski - CEO, 14 years in the company. Background in engineering and e-learning. It does not have a relevant percentage of the shares. There is not much information about his stock compensation, his salary is just €50k. He has been CEO for less than a year.

Robert Sendack - CEO of Makolab Consulting for a few months, has acquired 40% of the company. Experience as a consultant, both for major firms and independently.

Aligned board of directors, with a majority shareholder and with very contained remuneration. Pending to establish what alignment of interests the current CEO has (possibly package of options in the near future). Technical expertise abounds, to prove their ability as capital allocators.

4. Valuation.

Price as of 11/18/2021: 5.85 pln

Current valuation:

With this valuation I make the minimum possible assumptions, it is about knowing how much the company is worth right now, a value that should come to light as soon as the most immediate catalyst appears: expansion of margins at normalized levels.

The company will invoice about 53 M pln in 2021. I suppose growth of 15% in 2022, higher than the 11% it has had during the pandemic but lower than the previous 20%, the company itself recognizes that it is difficult for it to grow right now due to the shortage of professionals. Sales in 2022 of 61 M pln.

In November 2021, it trades at a P/E of 13, very low for a company with 20% growth and resistant to crisis. Other European IT consultancies trade at higher multiples. Umanis: 18, IT-Link: 21. Recently PGS Software, a Polish competitor, has been offered at P/E 18.

The company renegotiates contracts to recover a 10% net margin.

AP/E 18 we have a target value of 15 pln. An upside of 150% from the current price.

Valuation in 2025:

We assume a return to growth of 10% - 20% from 2023, net margin remains between 8% and 10%.

Below are pessimistic, probable and optimistic scenarios:

5. Catalyst

The company has potential for multiples expansion in two ways: growth and expansion of margins. The most immediate is the recovery of margins, which should come from a price increase during 2022 as current projects are completed and new projects are negotiated.

At a pure conjecture level, sales appear to be seasonal, being strongest in the second half of the year. This makes me think that the first quarter is when contracts are signed that will be billed by the hour and that they will be paid in the second half of the year. In the second half of 2022 we should see pre covid margins.