Good morning, Micro Investors!

Welcome to a new edition of Micro Caps in 10 minutes. If you are not yet subscribed, you can join the best newsletter for independent investors who are not afraid to invest in the most unknown companies in the market. If you are a colonizer of the micro cap universe, this is your place.

Today, in 10 minutes:

1 - Portfolio update: March 2023

2 - ININ Group, a special situation

3 - Offshore supply vessel market

Portfolio update: March 2023

Positions:

Transactions:

Return:

Portfolio return from last update in January is +2.0%.

I have sold all my GEE Group shares. The reason behind this is the board's refusal to buy back shares at the last investor conference. They have expressed their intention to continue making acquisitions, even though the stock is trading at 5x earnings. It seems to me that they are not aligned with the shareholders, and I see a clear risk that they will destroy capital by buying businesses at high prices. It seems their incentive right now is bonuses, which are based on earnings, and not earnings per share.

On the buying side, we have Tenderhut, where I'm adding shares slowly, given the low liquidity. If you haven't seen the quick thesis on Tenderhut, here it is. It certainly seems to me that it has a lot of potential:

The biggest buy is HAV Group, where I have continued to add as I have had liquidity. Truth be told, with some bad timing as I added above 11 NOK, when it has been below 9 NOK for a long time. But hey, we are not traders.

If you are interested in HAV Group, more about its markets in point 3 of this article.

In addition to these transactions, I bought a position close to 8% of the portfolio in ININ Group, which I closed after a few days, what happened?

ININ Group, special situation

ININ GROUP (ININ) has a market capitalization of NOK 310m. The company has two business lines, the first (ELOP Technology) develops a system for non-destructive inspection of concrete structures and still generates losses. The second is an industrial services business, focused on the railway industry. This line of business is profitable.

In February, ININ's board of directors announced that they have received a purchase offer for ELOP of $30M. This offer creates a rather special situation:

The result is that we pay NOK 310M for:

NOK 312m in shares of ELOP buyer. The sale is 100% in stock.

NOK 97m in cash + NOK 50m in credit receivable.

An industrial maintenance and services business with an EBIT of NOK 30-40M.

It's not hard to see that if we value the shares of the ELOP buyer for their transaction value and the services business at about 6 times EBIT, we have a value of 2 times the current price.

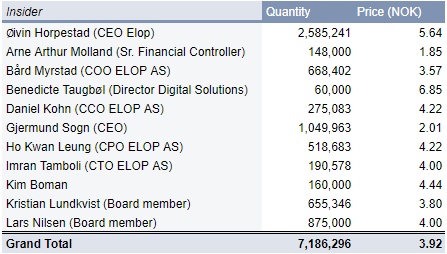

And it seems that the board also believes that the company is undervalued, because they have been buying shares (in total 7M shares of the 123M outstanding). This, together with the repurchase of 5% of the shares by the company, provides us with all the ingredients of a special situation.

However, after buying an 8% position, I decided to sell it within a few days. The main reason is this announcement of the directive where they change the structure of the company to an investment company.

The management team has set up another company, which they own, and is going to charge management fees to the main company. These rates are yet to be defined but will be based on revenue, purchases and sales made, and profitability for shareholders. For example, they have set a 20% fee on all returns above 8%.

Oh, and in addition to this, they approved stock options that dilute the shareholder by 7.5% in 3 years.

All the alignment that commented on the directive? Well, in my humble opinion, here it is lost. Not to say that the opportunity stops providing upside, but the margin of safety of “if the sale doesn't go through, I'm left with a quality owner-managed business” is no longer there.

Conclusion: I prefer to sell and assign the position to other opportunities. I'll keep watching the company.

Offshore supply vessel market

In the second edition of Micro Caps in 10 minutes: “Rooftops and Boats” I introduced the case of HAV Group, a company that designs eco boats, electric and hydrogen marine propulsion systems and water cleaning equipment. One of the main markets for HAV is the design of offshore supply vessels (OSV). These vessels are used during the assembly and operation of oil platforms and offshore wind farms.

Well, it turns out that the offshore energy market is very interesting, both oil and gas (O&G) and offshore wind. Two markets that have nothing to do with each other, but expect high growth in the coming years.

I recommend reviewing the last two editions of Weekly Insiders, you will see that companies related to these two sectors consistently repeat on the insiders' shopping list. Looks like we have a trend.

Let's see what this is all about.

Oil and gas offshore supply vessels

This has been the main market for HAV until '17, where we can see a very sharp drop since production peaks in '13.

Compare this to the revenue of one of the world's largest operators of OSV for O&G, Tidewater (NYE:TDW):

The high investment in offshore projects, supported by the high prices (above $100 since '11) translated into a high demand for service ships for oil platforms.

Daily rates reached peaks of $18k in '15.

Then oil prices fell to as low as $32/barrel and offshore projects were cancelled.

Daily rates hit lows of $9,500 for Tidewater in '19.

This, combined with low fleet utilization, caused TDW revenue to fall 80% from highs. This situation has been maintained during the pandemic, oil prices below $50 - $60 make offshore projects unfeasible.

However, it seems that this is beginning to change, since the war in Ukraine the prices of a barrel of brent have once again exceeded $100, offshore projects are reactivated and exploration is back.

The result

Fleet utilization is up, and TDW daily rates have increased 32% YoY in Q3 '22, surpassing $13K (not seen since '16).

What is coming next?

Everything indicates that we are coming from a valley period of the cycle for operators and builders of OSV for O&G. Companies like TDW have been losing money for 8 years, this usually goes hand in hand with an increase in the scrapping of ships and old fleets.

The TDW fleet has an average age of 12.2 years, compared to 5.7 in '12.

In the futures market, Brent is trading at around $70 in '26 and offshore production costs are estimated to have dropped to $43/barrel.

Research firm Rystad Energy has published a report predicting a return on investment in this sector, with $200B invested up to '25.

The offshore oil and gas (O&G) sector is set for the highest growth in a decade in the next two years, with $214 billion of new project investments lined up. Rystad Energy research shows that annual greenfield capital expenditure (capex) broke the $100 billion threshold in 2022 and will break it again in 2023 – the first breach for two straight years since 2012 and 2013.

-Rystad Energy

If Brent barrel prices continue as they are now, it is very likely that we will see new investment in offshore platforms. This coupled with an aging fleet is likely to cause another cycle of high OSV demand.

The market does not look bad at all in the coming years.

Offshore wind supply vessels

Since '20 HAV has started designing OSVs for the offshore wind energy sector. What opportunities do you have in this sector?

Let's take a look at the study of the US Department of Energy of '22 where we are presented with the projections of this market.

Global offshore wind energy deployment is forecast by 4C Offshore and BloombergNEF to increase globally to about 260 GW or more by 2030 (4C Offshore [2022]; BloombergNEF [2021]) and the number of countries currently generating from offshore wind is expected to double over the next decade (Ferris 2022).

Europe is expected to hold 45%‒50% of the total installed global offshore wind capacity by 2031.

The estimated levelized cost of energy (LCOE) for fixed-bottom projects commissioned in 2021 has declined to $84/megawatthour (MWh) on average, with a range of $61/MWh to $116/MWh globally. Industry experts estimate that levelized cost of energy will be $60/MWh on average by 2030.

-Energy.gov study

Other studies show us a similar perspective, such as the one carried out by DNV, an energy and maritime transport consulting company.

In Europe 50% of electricity will come from wind

From today to 2050, wind capacity will grow 9-fold, onshore wind 7-fold, and offshore wind 56-fold. LCOE for fixed and floating offshore wind reduces 39% and 84%, respectively, in our forecast period. Even relatively mature onshore wind sees cost reductions of 52%. These developments fuel the rise of on-grid wind from 1,600 TWh/yr in 2020 to 19,000 TWh/yr in 2050. By 2050, wind will provide almost 50% of on-grid electricity in Europe, and 40% in North America and Latin America.

Grid electricity from wind increases from 1.6 PWh/yr in 2020 to 19 PWh/yr in 2050, with Greater China, Europe and North America leading in output, and OECD and Latin America growing sharply from 2030. Europe and OECD Pacific will have the highest shares of offshore wind.

They predict a 56x increase up to '50 in installed offshore wind capacity.

We have a potential market that will multiply x5 until 2030, where Europe will have a 50% share and with projects under construction for 50% of existing capacity. If this isn't growth, I don't know what is.

Other studies agree, with Rystad Energy predicting that offshore wind investment will be $102B in '30, compared to $42B in '21.

If you have liked ❤️ this Micro Caps in 10 minutes edition you can subscribe so you don’t miss anything.

Comments section is 200% open to ideas of Micro Caps to review in next editions ⬇️⬇️⬇️

See you!

Dani

is there a link to your writeup/thesis on pax?