Research | LSI Software. Hospitality and cinemas

Stable business with some growth and optionality.

LSI Software (WSE: LSI) is engaged in the sale of hardware and software for hospitality, restaurants and cinemas. It has a stable business with a large market share in Poland and is now starting an international expansion of its POSitive Cinema which has the potential to multiply its profits.

Disclaimer: Do your own research. The author of this post has a position in this company, which is also illiquid.

1 - Key points

Growth 10-15%

ROCE 30%

Insiders aligned with 30% of the company

P/E 5

Large spending on R&D. Operating leverage.

Estimated return: 35% CAGR

The investment opportunity in LSI Software comes from the fact that we are buying a company that integrates hardware and specific software for hotels, cinemas and restaurants at less than 5 times profits, which grows moderately. Behind this, we have an ERP software for cinemas that is growing at a rate of more than 30% per year and that is beginning its international expansion.

If the optionality of the ERP software for cinemas goes wrong, we keep the base business, which protects us because of the low multiple. If the optionality works out and the ERP for cinemas achieves a relevant market share, LSI can multiply its sales by 3 - 5 times and make us a nice 10 bagger.

1.1. Why does this opportunity exist?

€7M Nano Cap, with 30% of the shares controlled by the founder.

Very illiquid, less than €5,000 per day. Only suitable for private investors.

Not followed by analysts or publicized. Periodic reports in Polish.

Temporary growth slowdown and margin contraction due to the pandemic.

1.2. Risks

Failure of the ERP software for cinemas POSitive Cinema. Continuation of investment in R&D for this software without results.

Wage inflation in Poland.

Recession in Poland and the rest of Europe, causing a decrease in its core business.

Management capability to escalate company outside Poland, capital allocation.

2. What does the company do?

LSI is dedicated to the development and implementation of ERP systems for hotels, cinemas and retail, as well as the sale of equipment (self-service kiosks for restaurants, point of sale systems...) its installation and maintenance.

LSI has 3 segments:

-Hardware Sales: Points of sale, self-service kiosks, PDAs and screens for order management… This segment brings approximately 50% of sales in 2021.

-Services: Installation of the hardware they sell, adaptation of ERPs both own and third parties. General integration of hardware and software to the needs of each client. Approximately 25% of sales in 2021

-In-house software: ERP software licenses developed for clients. Approximately another 25% of sales in 2021.

Restaurants

LSI has developed the ERP Gastro and Positive Restaurant for restaurants. It is a comprehensive system, which is installed in point of sale terminals and allows them to be configured to the needs of each location. GASTRO has functionality for the general management of restaurants or bars. This includes sales and profit management, inventory, or worker hours and shifts.

LSI also provides other hardware such as self-service kiosks, "pagers" that indicate to the customer that their order is ready, and other hardware used by waiters and cooks.

In addition to providing software, LSI also acts as an integrator, installing software, hardware, and providing maintenance.LSI is a partner of the brands Posiflex of POS and Pudu Robots of autonomous table service robots.

I have not found information on the geographical distribution of the ERP for restaurants but the sales page is in Polish, it seems like these systems are marketed exclusively within Poland.

Hotels

LSI Software has developed Positive Hotel, which is a comprehensive management system for hotels or hotel chains. It is a modular system that is combined with other software packages developed by LSI for the management of reservations, clients, hotel personnel and the automation of elements such as card room access. It has specific modules for businesses like spas or golf courses.

As in the case of restaurants, LSI integrates this software with the necessary hardware, installs it and provides maintenance. The information is in Polish, so it is another area of the company where I suppose there is no international expansion.

Hotels

Software package Positive Cinema. In line with the software packages that we have already seen for restaurants and hotels, but with specific functionality for cinema management, such as:

Projection programming.

Automatic playlists, with movie screenings and commercials.

Automation of projectors and rooms.

Information management with film providers.

Sales and promotions.

It is a complete system, which they continue to develop and where most of the company's R&D budget is going. The latest module they have added is Smart Cinema, which helps theaters optimize occupancy and ticket prices.

Market share Positive Cinema has grown rapidly since its launch in 2017. It currently has more than 75% of the market share in Poland, and is in the process of expanding internationally. This expansion began in 2019 and since then LSI Software has signed contracts with foreign companies for a significant value in relation to the company's total turnover (54M PLN in '21):

Feb. '20. Contract with Next Generation LLC, a Saudi Arabian chain. Implementation in 19 cinemas, value of 3.7M PLN to be executed in '20. 186 screens.

June '20. Contract with KITAG Kino-Theater, in Zurich. Value of 9.2M PLN, to be executed in 5 years. 76 screens.

Jan. '21. Contract with Silky Otter Cinemas, in New Zealand. Unpublished value. The fact that they have expanded into New Zealand is interesting because that is where their biggest competitor, Vista Group, is located (more on this at point 4).

Apr. '21. Contract with Classic Cinemas in the US, 15 cinemas and 131 screens. Unpublished value.

During 2020, LSI recruited Emanuele de Plano as head of sales for Positive Cinema. Emanuele has over 15 years of experience with cinema software products, and prior to joining LSI, he was General Manager for Veezi in EMEA. Veezi is one of the products of Vista Group, Positive Cinema's competitor. Additions like this are yet another reason to be optimistic about Positive Cinema development in the coming years.

Conclusion: Positive Cinema is a top-tier software, with competitive features that have earned it more than 75% market share in Poland and international growth with contracts in several countries. LSI is investing heavily in improving this software and building a sales team capable of further expanding it.

3. The market

LSI Software services are divided into two markets:

Hardware: Points of sale, inventory management, orders.

Software: ERPs.

Let's look at a couple of studies to get an idea of the future growth of these markets.

Point of Sale Hardware Market. 15% growth through 2029.

Grand View Research. Growth of 8.5% until 2030.

Restaurant management systems, growth of 15% until 2030. Fragmented market, Toast ($TOST), one of the biggest competitors in the sector, has a 7% market share.

Hotel management systems, growth of 6% until 2025. Another fragmented market, one of the biggest competitors, Cloudbets has had sales of $30M in 2021, which corresponds to a market share of approximately 1%.

Cinema management system, growth 4.5% until 2028. Vista group has a 50% market share in the segment of 20 screens or more.

Conclusion: The markets where the company operates are fragmented, except in the case of cinema software, where there is a main competitor. Everyone expects single to double digit growth.

4. Sales and profits

LSI sales have grown at a CAGR of 14% between 2007 and 2017, going from just 21M PLN to 47M PLN in that period. The high growth in 2017 is due to the acquisition of GiP, one of its competitors within Poland in the development and sale of ERPs for hospitality.

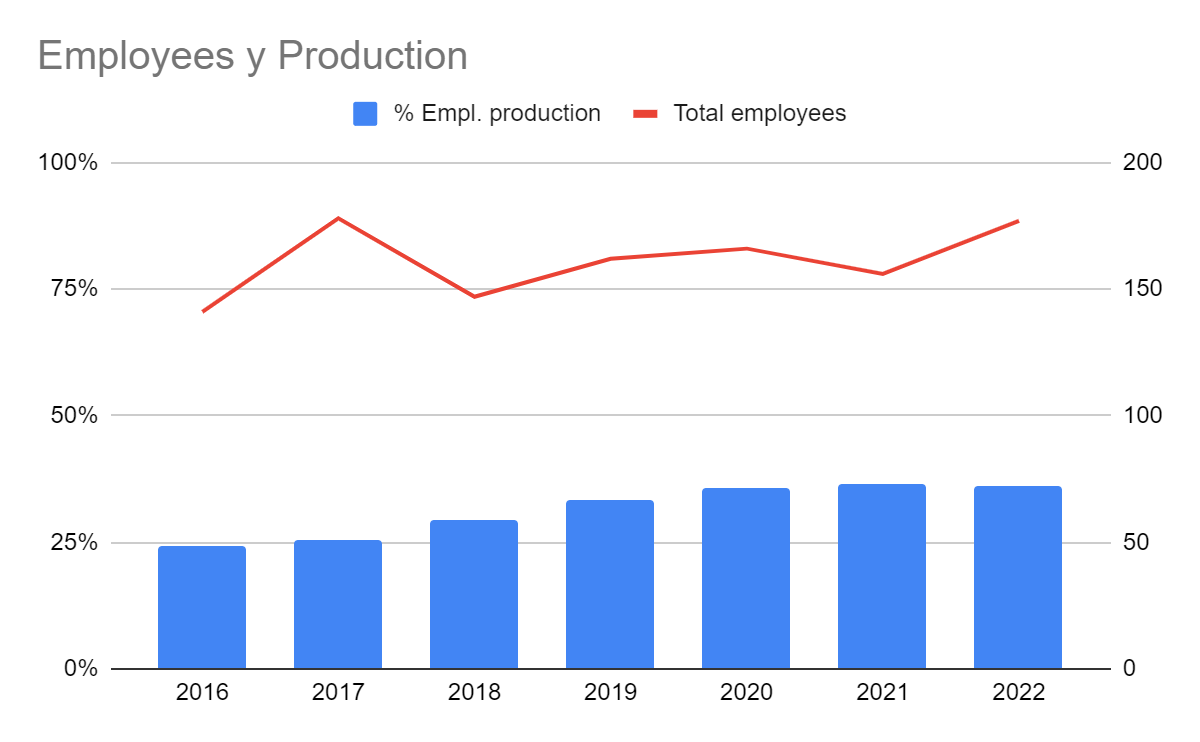

As of 2017 we have a growth of only 3%. LSI had to digest the acquisition, which added 25% to its number of employees (178 in 2017 vs 141 in 2016). LSI managed to reduce headcount due to synergies, keeping 147 in 2018, almost the same as before the acquisition with a 44% more sales.

In 2019 the company returned to growth, and in 2020 it saw its sales drop just under 20% due to COVID. This is to be expected, considering that LSI clients were forced to close. In 2021 we already have a higher profit than before the pandemic.

However, if we dig a little deeper, we find that LSI has been receiving aid from the government, that have inflated its benefits, and that it may not receive it in the future.

"This looks bad Dani"

Well, let's see.

Government grants

LSI has been receiving grants for years, mainly from the European Union. The purpose of these grants, until 2020, was for R&D and they have used this money for the development of their ERP Positive Cinema. This money has helped pay for all the R&D that LSI is doing, which we will see is remarkable in relation to its size.

The increase in subsidies in 2020 and 2021 is due to aid from the Polish government for companies affected by the pandemic. Even without these aids, the profit margin before taxes in 2019 was 11%. In 2021, although sales recovered pre-pandemic values, the number of employees grew more, resulting in a lower margin. We will see this later in the R&D section.

But first, LSI is a profitable business and has been for many years. What has the board done with the money they have generated?

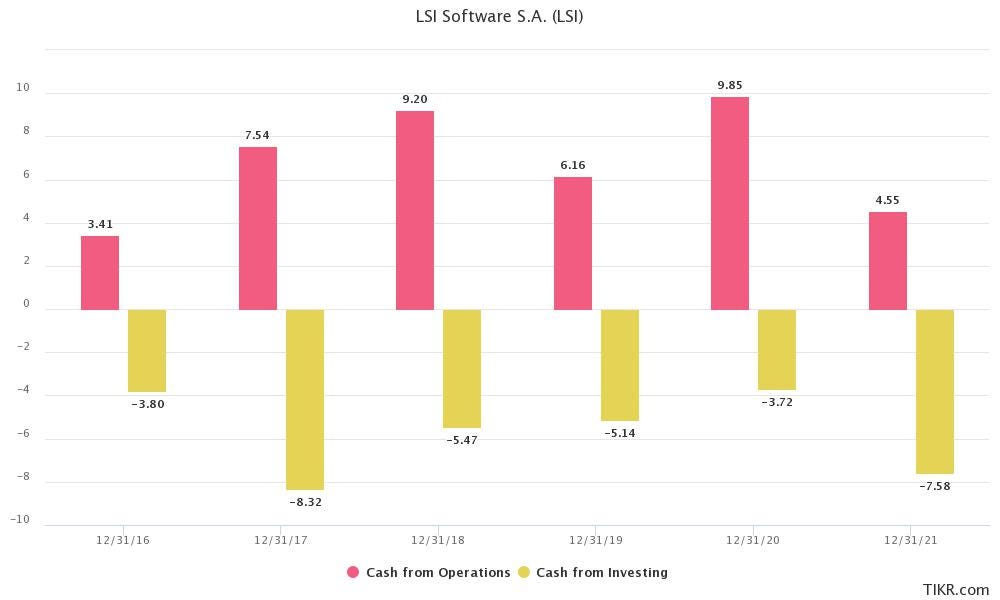

We've had 14% operating cash flow, good. But much of the cash has vanished in investments. The integrators usually have a very good conversion to FCF, this smells bad.

Why do they need so much CAPEX?

Let's see, from 2016 to 2021 the company has generated 41M PLN in its operations.

Of those 41M PLN:

7M - increase in cash in bank accounts (They have 12.5M in total at the end of 2021).

34M - CAPEX. Divided into:

25M - Capital expenditures on own applications developed. Of these 25M there are 14M left on the balance sheet yet to be amortized (which will save us almost 3M in taxes).

4.6M - Acquisition of GiP in 2017.

3.4M - Acquisition of rights and licenses in 2021, possibly due to becoming integrators of Pudu robotics.

1M - Others.

Well, it seems that the cash has not gone away (which in the world of micro caps means a lot).

The company has been quite conservative and has more cash than it needs, they have already made an acquisition in 2017 so they could use it to buy some other company. The use of cash is something that we must always monitor, but the management has not misused it in the past:

2019 - Dividend of 0.5 PLN/share.

2018 - Dividend of 0.3 PLN/share.

2017 - Purchase of GiP, its biggest competitor in Poland.

I see high possibilities of dividends or future acquisitions.

But by far LSI has invested most of the cash it has generated over the last 5 years in proprietary software development. And this is a central part of the investment thesis, we have a hidden asset that is already developed. We have sown and are ready to reap fruit.

Hidden assets and growth

Even if it’s named LSI Software, the sale of software licenses is not the activity that reports the most income to the company. In fact, in 2015, the sale of software licenses accounted for only 10% of revenue. Since then the company has been investing mainly in the development of its “POSitive” platform, which it is now using for cinemas but is also beginning to apply to the hospitality industry.

This has been the result:

License sales have grown by 30% per year since 2016. The growth has accelerated since 2018, when the company started selling outside Poland, its country of origin. LSI international sales have grown since 2018 at 80%-100% per year, excluding 2020.

It is always interesting to see the evolution of the number of employees compared to sales. LSI Software's employees have grown less than sales in the last 5 years. Which is a good sign. The employees dedicated to the production of their own software have also stabilized. They do more with the same resources.

POSitive ERP is what I think can bring international growth to LSI Software, so it is worth to analyze if this asset is of quality or is receiving sales due to heavy discounts against the competition. Let's try to calculate unit sales ($/screen) for POSitive versus its competition, Vista:

Vista: Gives us pretty accurate data. 53,000 screens, sales of $60M. $1528/screen per year.

POSitive: Data less segregated. We will assume that all the growth in license sales since 2018 has come from POSitive (not being too optimistic, before launching POSitive in 2017, LSI sold 3.7M PLN in licenses, in 2018 already 8.2M and in 2019 12M ).

700 screens. Sales of 6.6M PLN (14.8M 2021 vs 8.2M in 2018). $2300/screen per year.

Contract with Blue Cinemas. 9.7M PLN, 5 years. 76 screens. $6,300/screen per year (including hardware and implementation services).

The higher cost per screen makes sense because Vista is targeting large chains with hundreds or thousands of screens. But in any case, it is hard to conclude that LSI is selling its product at deep discounts to capture growth at any cost. If we add growth to this, it seems that their product is competitive both nationally and internationally.

But Dani, LSI spends 50% of license revenue on R&D. What margins can we expect in the future?

Normalized margin

To arrive at a normalized margin I am going to make two adjustments:

Base margin: The ones we got from 2017 to 2019. In 2020 and 2021 the company is still affected by the pandemic.

R&D: I adjust it to 20% of license sales, this value is quite constant in software companies with moderate growth.

Adjusting for R&D at 20% of license sales we arrive at an EBT margin of 16% or a net margin of 12.5%.

This margin, in fact, is similar to what we had in 2018 and 2019 thanks to government research grants.

I will assume a margin of 12% for the optimistic case and 10% for the most likely thesis. In Poland, as we have seen in other theses already published, there is a severe salary inflation among professionals in the IT sector that could erode margins in the short term. This inflation is not exclusive to Poland and it is expected that LSI will be able to pass costs on to clients. Wage inflation also makes it more expensive for potential competitors to develop the software that LSI already has.

Conclusion: LSI already has a large share of the hardware and ERP market for small hotel, restaurant and cinema businesses in Poland. This business is stable but growth is limited. However, LSI has the “POSitive” ERP, in which they have invested a large part of their profits in recent years and which they have started selling outside of Poland 4 years ago.

The sales growth of this software is remarkable (30%-50%) and the potential market outside of Poland is several times the current turnover of the company. However, this growth has been camouflaged on the income sheet due to the small weight compared to total sales. It is a hidden asset that we can expect to grow over the next 5 years and will increasingly impact total sales.

5. Management

Grzegorz Siewiera, its founder. It has 30% of the shares and 53% of the votes. His salary is less than €30,000 a year, so almost all of his assets are in LSI shares. He has studied Economics in Poland and an MBA in the US. The alignment is maximum. Grzegorz left his position as CEO of LSI in 2019 to take charge of POSitive USA, and personally take charge of starting the international expansion of what, as I have mentioned, is the product with the greatest potential of the company. In 2021 he returned to his position as CEO of LSI.

Michal Czwojdzinski - Has 0.9% of the shares. He was the president of GiP. Has bought shares during 2020.

Piotr Kraska - Chairman of Yavin Limited investment fund. It has 14% of the shares.

Inmuebles Polo SL - Private investor through company. It has 11% of the shares. No active role.

6. Valuation

$LSI: 11.5 PLN/share

LSI, as of today (09/27/2021) is extremely undervalued. In fact, the market gives a company valuation in decline or cyclical, when it is not. Quick numbers go:

Market Cap: 37M We

subtract 12M PLN effective at the end of 2021

We subtract 1.9 taxes avoided for amortization of intangibles.

We have PLN23M of EV left

If we assume PLN60M sales in 2022 at 10% normalized net margin we can buy LSI at 4x net profit. This is assuming that we do not generate cash in 2022.

LSI should trade at 10x - 15x net profit. I won't dwell too long on this assessment, because it is similar to the KBJ and Makolab. If I gave these multiples between 13-20, I give LSI somewhat lower multiples for being in a sector with less tailwinds and needing more capital expenditure (software development, warehouses...)

If the ERP software option comes out well and recurring license sales become the company's main revenue stream, multiples should be more in the 20x profit range. Its competitor Vista Group ($VGL) is trading at 35x 2019 earnings.

Using an adjusted net margin of 10% (see point 6) gives us about 6M PLN earnings in 2022 and a value today of 20 - 30 PLN per share.

Future scenarios:

That’s all!

Comments are VERY welcomed, even if you disagree with me.

Regards,

Dani