Good morning Micro Investors!

Welcome to Micro Caps in 10 minutes. If you are not yet subscribed, you can join the best newsletter for independent investors who are not afraid to invest in the most unknown companies in the market. If you are a colonizer of the micro cap universe, this is your site.

In this new section, which I will publish every 2 Fridays, we will review updates on the companies in the portfolio, news and investment (or non-investment) ideas. With this I will try to publish content in a more consistent way without limiting the newsletter to only long company reviews.

Today in 10 minutes:

1 - Idea: Atlas Engineered Products. Wood Roofing in Canada Inflated Income?

2 - Idea: HAV Group. Eco boats.

Idea: Atlas Engineered Products. Structures for wooden roofs.

I think that AEP is not as cheap as it seems. Keep reading.

Atlas Engineered products (TSXV:AEP) is engaged in the manufacture of timber roof structures. These large structures are an essential part of single-family and semi-detached homes in both Canada and the United States. It is a business with many of the ingredients of good investments, such as being run by its founder, repurchasing shares and, above all, having the ability to reinvest profits at high rates of return due to its M&A strategy.

Atlas buys businesses in a fragmented sector at 4x EBITDA and makes them more efficient, resulting in multiples of 2.5x - 3x EBITDA. Taking into account that the market is highly fragmented this should allow them to compound capital at >20% over the next 5 years. Adding this to the fact that the purchases are made with a certain amount of debt (>50%), the ROE can be above 35%. The possibility of continuing to reinvest is high, since the sector is made up of thousands of small businesses, most with less than 5 workers.

When buying small businesses, Atlas incorporates efficiency measures, such as automation or scale in purchases. It seems to me that it has all the ingredients to be a quality compounder.

Oh, did I mention that the roof structures are large? They are large, transportation is expensive and complicated, making geography a barrier to entry. According to management, it is not economically viable to transport these structures more than 300km.

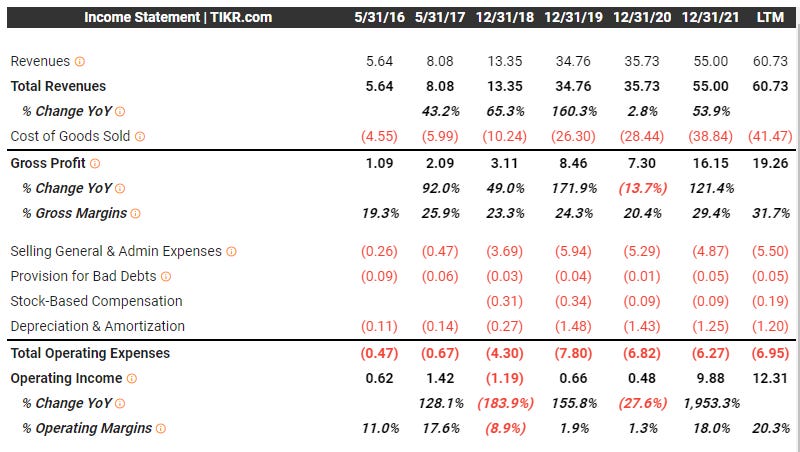

Atlas will sell about $65M in '22. and will generate net profits of about $8M. With the stock at $0.6 CAD, it is trading at 4.3x earnings.

Sales Growth

Sales growth has been impressive. The main source of growth through 2019 was acquisitions (in '18, for example, $8.5M was spent on acquisitions, when the company had $13M in sales). In '21 growth was mostly organic and the contribution from acquisitions was just $3.5M annually.

This organic growth worries me, because I believe that it does not come from an increase in production, but from an unsustainable price increase. This price increase is linked to the increase in wood prices.

Wood, the new gold

The pandemic, in '20, caused a disruption of the supply chain of wood products. This, together with the increase in new home construction in the United States and Canada, caused an explosion in the prices of wood and derivatives. In this article you can read more in detail about the supply chain and the causes of these price increases. The result is that the price of lumber tripled in one year and has remained volatile as crypto ever since. In recent months we see a normalization.

The prices of derived products have followed the evolution of the price of wood closely.

Engineered (construction) timber:

Roof structures:

The correlation is clear, and Atlas does not publish data on its production in terms of price increase vs. production increase, but I think price increase is the main factor. There are three factors that make me think so

1 - Cost of employees: Direct task cost dedicated to production was $9.5M in '21, vs $8.4M in '19, an increase of only 14%. Given wage inflation in the US and Canada, it doesn't seem like an increase in employees of more than 10%.

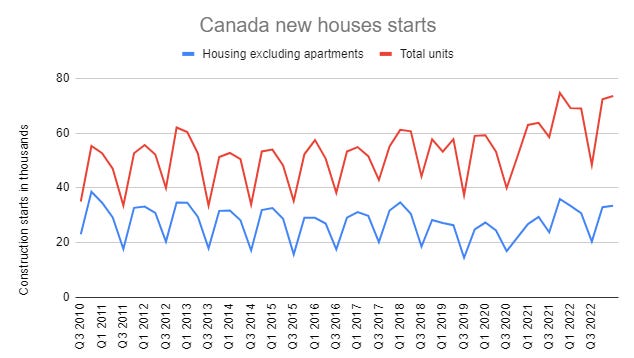

2 - New constructions have not increased by 50%: If we take a look at new housing constructions excluding apartments (usually concrete), they have not increased much.

3 - Other companies in the sector have had the same effect: For example, the Boise Cascade Company (NYSE:BCC), a US construction lumber company, has seen the same growth in '21 .

Margin growth

Atlas has not only increased its revenues, but also its margins, increasing its gross margins from 25% to 30% and its operating margins to 20%. Expenses like salaries, overhead, and depreciation are further diluted by selling at higher prices.

Other companies in the sector have had the same effect, Boise Cascade Company:

Variable Debt

Based on H1 '22 data, pay $416K in interest per year, most of it at a variable rate that could increase in the event of further interest rate hikes, making acquisitions less attractive. It is not a large amount compared to the current EBITDA, but it can become a higher percentage if the margins go down.

Normalized situation

Having an EBITDA margin of 22% and a net margin of 14% seems to me to be a situation at the peak of the cycle for an industrial company, coming from the price increase of recent years. I think it is reasonable to anticipate that the prices of wood and derived products will return to the pre-Covid average. In this situation, Atlas could lose much of the growth of '21 and '22, and sales could drop 20-30%.

The operating leverage effect works both ways. Some of this growth in sales can be offset by acquisitions, but those acquisitions will be made at higher normalized multiples and the business that we have bought at 4x EBITDA can be turned into an 8x EBITDA purchase.

Conclusion

I want to wait and see how the price of raw materials evolves. I guess there is value in trying to predict the cycle, and certainly if it takes 3-4 years for prices to come down to normal levels we could be looking at a wonderful buy. However, it is something that I am unable to predict and we have very attractive companies without this handicap.

With this I do not mean that Atlas is a bad business, it can probably continue to grow and create value for shareholders, but the market may already be partly discounting the price drop for its products.

What am I going to do

I’ll wait. If it goes back down to the $0.4 range, I am sure it will attract more attention. Of course I await the results of Q3 '22 and I will follow it closely. At the moment we have other opportunities.

Idea: HAV Group, ecological boats.

HAV Group (OB:HAV) is a spin off of the Havyard Group company, which was spun off in the first quarter of 2021. Havyard Group is a Norwegian shipyard, while HAV Group is responsible for efficient ship design and design and sales of ESG systems for boats. These systems include elements for water purification and low emission propulsion. Unlike its parent, it is a capital-light business, providing component designs and integration and not executing the construction of the ships, so it has few fixed assets.

HAV has 4 segments:

-HAV design: Design efficient boats that use less fuel to move. He also designs efficiency-focused mods for existing ships.

- Norwegian Greentech: Designs disinfection systems for ballast tanks. These systems use UVA rays to eliminate organisms from the water that may affect native marine life and have been mandatory for a few years. Also applicable to rapidly growing land-based aquaculture

-Norwegian Electric Systems: Retrofit electric propulsion systems for ships, both new and existing.

-HAV Hydrogen: Hydrogen-based propulsion systems. It has still been created recently and is in the R&D process, so it does not contribute to sales.

HAV is trading at NOK 350M (about $35M) and has NOK 300M in cash. Not all of this cash is “real” since it is prepaid by customers, so it is accompanied by a liability. However the EV is about 280M NOK. Profits in '21 were NOK 70M, so trading at 4x net profits. The large amount of cash he has is using it to repurchase shares, in the last year he has repurchased 6% of the shares and has approved repurchases up to 20%.

The stock has fallen from the NOK15 it was listed at to NOK11 it is now in part because parent Havyard Holdings, which owned 66% of HAV, distributed almost all of its stake as dividends. Insiders, such as the CEO and CFO were already executives at Havyard and went to HAV with the spin off. HAV is owned by one family, the Sævik family, which owns 25% of the company. The insiders are in the same boat as the shareholders, never better said, and also believe that the company is cheap and buy back shares aggressively.

Sounds like an interesting special situation. In fact, at current prices, any earnings growth in the following 5 years would give us high returns.

Sector with tailwinds

Greenhouse gas reduction targets in the maritime industry are set by the IMO (International Maritime Organization) with the support of major countries. The current objective is a reduction of between 50% and 70% in the emission of greenhouse gases by the industry. For this, some immediate measures and others in the long term are being implemented.

From '23 all large ships will have to undergo an analysis of their efficiency and will be classified with an index (EEDI). Measures will be implemented to increase this index, based on prohibitions, requirements or taxes.

The possibility of taxes on the consumption of fuel oil is being actively discussed, to favor the most efficient ships. Multinational shipping companies like Maersk and countries like the G27 have supported this measure.

Couple this with new builds relative to fleet size being at a minimum and we have a favorable environment for HAV design and Norwegian Electric.

There are 3 fuels that will be used for the energy transition of ships: hydrogen, ammonia and methanol. Methanol is the easiest of the 3 to use and is already used by the Maersk shipping company. Hydrogen is the only one that produces zero CO2 but it is more complicated to use. It is reasonable to think that all 3 will gain use depending on the application.

The other branch of HAV, the design of water treatment systems has growth potential in the land-based aquaculture market.

Little competition

HAV works in a sector with a handful of competitors. The biggest competitive advantage that the company has is that they retain the rights to their designs, this history of previous designs helps them save time when carrying out new projects, which they can adapt to the client's needs based on an already proven base.

Growth

The company's backlog is cyclical, depending on when new projects are signed. Sales in '22 will be lower than '21 providing also lower margins. The directive gives a sales forecast in '25 of NOK 1.2B compared to NOK 900M in '21 and NOK 600M in '22.

Conclusion

An engineering firm in an industry with tailwinds and barriers to entry. Aligned management, run by a family involved in other businesses in the sector and who buy back shares like crazy. It is not a business that should trade at 4x net profit last year, even if it is relatively cyclical.

What I'm going to do

I'll wait for the 3Q results on 11/30/22 and possibly buy some shares.

Next in Micro Caps in 10 minutes…

-Idea: Canadian security business.

Close to being sold this year, sale blocked by founder and another shareholder. Sale was at double current price.

Security for the richest 1% of Canada.

-In portfolio: Makolab, results Q3

Growth continued

Some margin recovery

If you have liked ❤️ this Micro Caps in 10 minutes edition you can subscribe so you don’t miss anything.

Comments section is 200% open to ideas of Micro Caps to review in next editions ⬇️⬇️⬇️

Dear Daniel,

many thanks for this and other insightful blog posts. Just stopping here to say I enjoy your work and you are covering an interesting segment of the market that I also find fascinating. I believe there is a lot of value to be found in Ex US microcaps while at the same time you need to look quite closely at the companies and sometimes information available is limited. That said, I am looking forward to read more from you. Happy to exchange some potentially interesting names aswell if you care.

Best

Carsten