Sebino | Fire and Security

Fire protection, maintenance and security. Possibility of roll up model. P/E 8. High ROCE, capital light.

Hello everyone. Let's go with another investment thesis.

Nothing unusual, a company that I see as a safe bet for a business that has been doing something boring for decades, very necessary, with magnificent returns on capital and with a shareholder board that has decided to go public to accelerate growth through acquisitions.

A company “compounder” of manual, come on.

Disclaimer: Do your own research. The author of this post has a position in this company, which is also illiquid.

If this thesis seems useful to you or you have any suggestions or doubts, I leave you my twitter (open DM). You can also subscribe or leave a comment.

1. Key points

Growth 2016-2012 of 20% CAGR.

Order backlog growth of 50% in 2021.

Operating leverage, margins grow with sales.

ROIC of >40%.

No debt

Insiders own 75% of the company.

It trades at normalized P/E of 7.7 and EV/EBITDA of 4.6.

Expected return: 30% CAGR in 4 years.

Catalyst: Recovery of 2020 margins. Re-rating due to size increase. Acquisitions.

Opportunity to buy a family business with decades of experience in a critical sector with barriers to entry. Ability to continue to grow sales and profits at 20% per year, protected by low valuation and no debt.

1.1. Why does this opportunity exist?

Micro cap of €70M in the Italian market.

Little followed by analysts.

75% of the shares in private hands, little liquidity.

Contraction of margins at the end of 2021 due to inflation of raw materials and transport prices.

1.3. Risks

Slowdown in the development of e-commerce in Europe.

Inability of the board to acquire businesses or a market that is not as fragmented as we are told. Acquisitions at multiples that destroy value for shareholders.

Loss of important clients or large contracts.

New mobility restrictions or conflicts.

2. What does the company do?

Sebino is dedicated to the design, installation and maintenance of fire protection systems. To a lesser extent, it also carries out security system installations (surveillance and alarms) and maintenance services for all of the above. A rather boring business but, as we will see, profitable.

The company is mainly active in Italy (90%) although it also works in Romania (10%).

2.1. Fire protection.

When a company builds a warehouse or store, it needs to install a fire protection system consistent with the applicable regulations. Commercial elements are used for these systems, which are adapted to a custom design.

Pumps, water dispensers, pipes... are catalog items. Pipes and other elements are cut to size.

Sebino does not manufacture any of these elements, but is dedicated to designing the necessary system, buying the parts and commissioning the manufacture of custom elements. They only make small final adaptations that are more critical for the proper functioning of the system. Installation is also outsourced. They do take care of the final testing.

The fact that they do not manufacture makes it a light company on capital. They focus on activities with high added value, which ensure that customers have the guarantee that the installation will work correctly: good design, good adjustment of components and testing in accordance with regulations.

The fire protection sector.

The fire protection sector expects moderate growth, with tailwinds due to increased spending on logistics platforms derived from e-commerce. Large logistics platforms occupy huge surfaces and require expensive fire-fighting installations. Globally, 280-370 million square meters of new logistics platforms will be needed by 2030 according to a study by Prologis (warehouse construction company).

Amazon has invested $39B in Europe in 2020 (https://ecommercenews.eu/european-logistics-investmentse39-billion-in-2020/) and its expansion continues in 2021. Empty

warehouse space in Europe below 5% (https://www.cnbc.com/2021/02/09/european-warehouse-demand-surges-as-e-commerce-giants-snap-up-spaces.html)

The global fire protection market is expected to grow moderately, between 6%-7% until 2030. (https://www.prnewswire.com/news-releases/fire-protection-systems-market-size-worth-130-37-billion-by-2030-grand-view-research-inc-301477183.html)

In line with what Sebino itself expects, 7.4% until 2024.

2.2. Security systems.

They install anti-theft and fire alarm systems and security cameras. The fire-fighting systems in this category are alarms, different from the extinguishing systems of the previous point but quite complementary.

The process is similar to the previous one, the client's facilities are inspected, a security system is designed, the parts of the system are purchased, installed (by third parties or by Sebino itself) and tested.

The company tries to cross-sell these systems to its fire protection customers.

The security industry.

Sebino itself has published growth estimates for this sector up to 2024 of 10.3%. This growth is in line with other reports I have found on the sector.

Growth of "Smart Security" systems of 16% CAGR, mainly in markets outside Europe. https://www.technavio.com/report/smart-security-market-industry-analysis

Electronic Security Systems, 13% growth: https://www.researchnester.com/reports/electronic-security-market/344

The growth published by the board seems reasonable and in line with expectations. Like fire extinguishing systems, it is a sector with moderate growth.

I don't think it's worth going into more detail about whether the sector will grow at 8% or 13%, because it will vary between sectors and regions.

For Sebino, growth in this area should be closely linked to the growth of logistics platforms, where tens or hundreds of millions of euros in inventory are normally stored. These platforms require extensive surveillance systems.

23. Maintenance services.

Fire fighting systems are quite critical, so they are subject by law to periodic reviews. Sebino takes care of both these revisions and urgent maintenance in case of breakage. For periodic reviews, they provide the required legal certificates, stating that the facilities are in order.

In the field of extraordinary maintenance, they offer a 24/7 assistance service, both for repairs if necessary and monitoring of events (fire-fighting system that activates, alarm that goes off, smoke detector...)

3. How is business going? ?

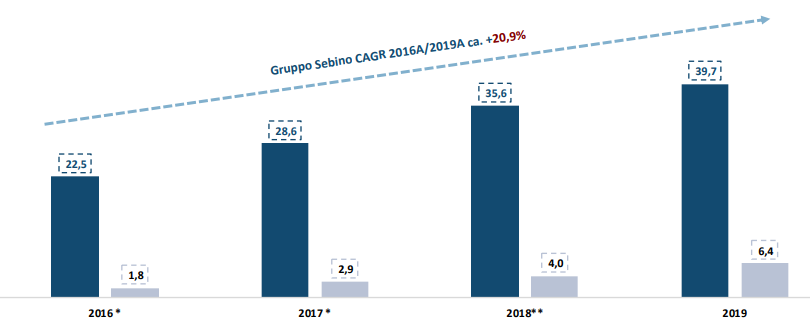

Sales from 2016 to 2019 have grown at a 20.9% CAGR. Some acquisitions are included in this growth, so it is not totally organic. In 2020 it has grown by 24% (11% organic in Italy) and in 2021 by 18.7% (15% organic in Italy).

Sebino Fire & Security

The results for 2019, 2020 and 2021 of the facilities business lines (Fire and Security) were as follows. Separate sales for Italy and Romania.

As the business scales up its EBITDA margin increases, it appears to have operating leverage, with a fixed cost structure.

The gross margin in 2020 has been 39%, with expenses for personnel, services and raw materials that have not increased compared to 2019.

But what has happened in 2021?

1 - Reduction of margins due to the increase in the cost of raw materials. Of all the company's expense items, one has increased disproportionately compared to income, raw materials.

The directive itself explains this phenomenon in the 2021 results.

The good part is that due to strong demand and the company's strong position, it expects to be able to raise prices to customers during 2022, and return to margins similar to 2020 (or even better if the price of raw materials falls).

2 - Drop in sales of the business in Romania due to the lockdowns. Sales have been lowered from €6.5M to €4M, and EBT from €1.2M to €0.2M. Therefore we have left €1M of EBT here. Orders at the end of 2021 are €7M (more than all sales of 2020) so it seems that the lost sales in 2021 have only been postponed to 2022 and we will see a year of a lot of growth in this country.

Preorders at the end of 2020 were €20M, at the end of 2021 €31.8M (+59%). Sales in 2021 of this line have been €49M. This confirms the strong demand that the directive speaks of.

The ROCE of this line of business is 59%, very high. As we have seen at the beginning of the report, the company subcontracts manufacturing and installation services and it seems that the management does a good job of keeping working capital low.

In short, it is a very high-quality business, where it is hardly necessary to reinvest to grow and it can continue to grow while generating FCF. This line of business has grown 20% in the past, while expanding margins. These margins can be maintained or expanded as the company gains scale. The situation of lower profits in 2021 seems temporary, caused by 2 factors that will be reversed between 2022 and 2023.

Sebino Service

In 2021, revenues from the Services business line were €9.8M, with an EBITDA of €1.3M, a margin of 13%. The ROCE of this business is 48%. Another high-quality business, with hardly any fixed assets and hardly any reinvestment. I also really like that this business is recurring, unlike the installation business, which is based on new projects. It is like a kind of facility management where maintenance is mandatory by law and critical, so the cost of change is large and lower price sensitivity.

The line of services, until 2019, was hardly important for the total business. Sales were €1.2M in 2019. In 2020 they acquired Riccardi SRL, a small competitor with sales of €9.4M and EBITDA of €0.6M. EBITDA growth seems outstanding to me, and can be explained by:

As the board has explained, the intention is to rationalize and integrate resources with the parent company, so it is to be hoped that economies of scale will be achieved.

The sale of higher value-added services to existing Riccardi customers, such as the Sebino Connect 24-hour monitoring service.

Even with these factors, I have to admit that doubling EBITDA seems like too much synergy. It is very possible that in 2021 we will have delayed service revenues from 2020, or an effect of the previous service contracts that it already had before the acquisition of Riccardi (it billed only €1.2M, but we do not know how profitable, nor how many contracts have already integrated into the subsidiary Sebino Service).

I leave myself as a pending point to review whether this new EBITDA margin is sustainable over time, but it is not unreasonable. This margin is higher than in other companies in the facility management sector (8%-10%) but it makes sense given the critical nature of the services they provide.

If this optimization of margins is sustainable, we could be facing a very high capacity to compose profits through acquisitions at low prices (see point 3.1).

On the other hand, we should not rule out organic growth, the board of directors expresses the intention of expanding Sebino Service using the base of clients:

The magnitude of this growth is unknown, so I will not take it into account, but it is the “free upside” that we always like.

3.1. Strategy

Organic growth of the line of installations

If both the fire protection and security sectors have grown at 7%-8% per year in the world, Sebino has been above average, it is a good indicator.

Looking to the future, growth should be maintained or in any case increased (as we have seen in the previous point, due to the growth of e-commerce). The management is optimistic and the truth is that seeing the results of 2021 there are reasons to be so:

Acquisitions

The increase in margins as a result of the increase in scale that we have seen in the point of margins together with the fragmentation of the market generates a good climate for acquisitions .

Sebino is in a good position to acquire small companies, pay their owners a reasonable multiple, and then grow margins through economies of scale.

Sebino's management already has experience in acquisitions:

Now that they are a listed company they have a greater capacity to obtain financing and make acquisitions.

The main targets for M&A according to the directive itself are companies in the service sector and the security sector, where the company can use its existing network of clients to generate cross-selling.

As we have already mentioned, the sector is fragmented. This helps make it possible to buy competitors at low prices. As an example we have the acquisition of Riccardi.

Acquisition of Riccardi

The purchase price that Sebino has paid for Riccardi has been very attractive, they have paid €1.5M. Riccardi had a turnover of €9.5M in 2019, with an EBITDA of €0.6M. The financial position at the time of purchase is €1M in debt. They have paid an EV/EBITDA of 4.2. Yes, it is little for a recurring business. But it's getting better.

The good thing is that in 2021, Sebino Service has invoiced €9.8M and has had an EBITDA of €1.3M. All (or almost all) of the turnover comes from the acquisition, so the increase in EBITDA has been notable. I have my doubts that this level of synergies is repeatable, but if it were, we would be looking at an EV/EBITDA of 2.

In conclusion, I see it as very possible to maintain the 10%-12% organic growth of the facilities sector, reaching 20% with acquisitions of companies in the service or security sector. The acquisitions of small companies are likely to obtain good purchase prices and keep the ROCE close to 20%. All this without taking into account any large acquisition in the fire protection sector that could expand the business in other countries.

4. Valuation

$SEB valuation as of today: €5.36. Market cap: €71M. EV: €66M

At current prices Sebino is trading at a P/E of 10 or an EV/EBITDA of 6. This valuation seems very reasonable in itself given the quality of the business and the tailwinds, but it is affected by temporary events that are already we have seen:

-Decrease in margins due to inflation of raw materials and broken supply chains.

-Sales reduction in Romania due to confinement in the first half of 2021.

Adjusting these events (margins + sales in Romania at 2020 levels, nothing crazy) we would have net profit of €9.3M and EBITDA of €14.2M.

P/E of 7.7 and EV/EBITDA of 4.6. Too little. We can obtain multiple objectives from fire installation companies and facility management companies:

-Johnson Controls ($JCI): HVAC installations, fire, security. Growth in line with the sector globally, 6%-8%. It does not have the same possibilities for growth through acquisitions due to its large size ($24B in sales). P/E 19. EV/EBITDA 13.

-GDI Facility Services ($GDI): Cleaning and maintenance services. Growth in the range of 10%-15% due to acquisitions. P/E 20, EV/EBITDA 11.

Both companies, the first that performs installations, and the second that performs maintenance services (less critical and with less added value) are trading at much higher multiples. I will assume a reasonable multiple for Sebino of 8 in case his growth stops, 13 in a normal case and 15 in a favorable case. I think its small size and the fact that it relies heavily on installation projects and little on recurring maintenance revenue creates a risk that will prevent higher multiples in the short term. If the company executes and increases its percentage of recurring revenue that can change.

Value Now: At a multiple of 13 times earnings and using normalized earnings Sebino should be worth €9-10.

Unfavorable case.

Organic growth slows to 3% in the facilities sector. The company can only dedicate 20% of the profits from this line of business to acquire companies in the service sector. It acquires them at EV/EBITDA of 6. Without debt.

P/E 8 in 2025 (ex. cash). Target price: €8.

Probable case.

Annual growth of 8% in the line of installations, less than in recent years. The company can dedicate 40% of its profits to acquire companies in the services sector at an EV/EBITDA of 5.

P/E 2025 13 (ex. cash). Target price: 16.

Favorable case.

Annual growth of 12% in the facilities line, dedicating 65% of profits to acquiring companies in the services sector at EV/EBITDA 3 (in line with the acquisition of Riccardi).

P/E 2025 15 (ex. cash). Target price: 23

4.1. Catalysts

Recovery of margins to 2020 levels: The company has reached a price of €7.5 in September 2021, the price has fallen since the board announced that 2021 margins would suffer due to bottlenecks and inflation. A recovery in margins at the end of 2022 could return the stock to these levels.

Acquisitions: The Ricardi acquisition has generated a lot of value for shareholders by resulting in an EV/EBITDA of just over 2. Other similar acquisitions will drive up the share price. The company now has access to credit, €20M in cash and the intention of the board to make purchases.

Win some big project.

Keep growing: More in the long term, continuing with past growth and compounding at high rates is the best catalyst.

5. Board

The CEO of Sebino is Gianluigi Mussinelli, the cousin of founder Marco Cadei. Gianluigi has been CEO since 2010 and has 45% of the company through the company Nexus SRL The rest of the company is in the hands of other members of the Cadei family, who have 37% of the company. The CFO Giovanni Romagnoni has 4% of the company.

Both the CEO and the CFO have experience of several decades in positions in the industrial sector:

As a conclusion, the management has more than 50% of the shares of Sebino, this presumably represents the majority of its capital (they do not have other sources of capital, at less known) so the alignment of interests is evident.

And here's today's thesis. A company in which I have the confidence to put >10% of my portfolio and leave it for 5 years composing thanks to the tailwinds of the ecommerce sector.

If you liked this research, please considering sharing or subscribing.

Cheers!

Dani

Hi! Thanks for your comment.

I believe they want indeed to increase the public float, as the CEO sold recently part of his shares to get the public float over 20% (lower minimum share lot requirement and easier to buy by institutions). I think shareholder and management interests are well aligned as management compensation is not relevant in relation to their stake (CEO compensation around 200K vs 30M stake). Also, other shareholders (founding family) have around 36% of stake, so no risk of company being used as cash cow by CEO.

Risk of expropriation is not zero, I would keep an eye on the company holding big amounts of cash, as this would mean:

1 - No M&A opportunities for the services line (recurrent, possible multiple expansion).

2 - Easier to use cash to acquire company if shares are undervalued.

Kind regards,

Dani

Hello Dani,

Thanks for the great write up!

What do you think is the end game for the owners here? Will they exit by increasing the public float? How are they incentivized at the moment? What are their compensation arrangements? Do you think there is risk here for minority shareholder expropriation?

Thanks again, keep up the good work.