Good morning Micro Investors!

Welcome to Micro Caps in 10 minutes. If you are not yet subscribed, you can join the best newsletter for independent investors who are not afraid to invest in the most unknown companies in the market. If you are a colonizer of the micro cap universe, this is your site.

In this new section, which I will publish every 2 Fridays, we will review updates on the companies in the portfolio, news and investment (or non-investment) ideas. With this I will try to publish content in a more consistent way without limiting the newsletter to only long company reviews.

Today in 10 minutes:

1 - Idea: Avante Logixx. Security for the 1%.

2 - In Portfolio: Makolab. They hire wisely, raise prices.

Idea: Avante Logixx. Security for the 1%.

Avante Logixx is an investment idea that stems from a special situation, a failed sale and privatization of the company, which was blocked by the founder together with one of the main shareholders. The result is that the company sold a part of its lower quality business (business security) and kept the higher-quality part (security for high-net-worth neighborhoods).

The company canceled all its debt and was left with about $12M in cash. With a Market Cap of $20M, we are left with an EV of $8M for a business:

Stable, resistant to crises.

Recurring (53% of revenues are recurring subscriptions)

Run by its founder and shareholder.

In the process of implementing cost control measures, such as office closures, which should give us an annual EBITDA of $2-$3M in the coming quarters.

With an important part of fixed management expenses, which will not scale with the increase in income. If the business makes acquisitions with the $12M it has in cash, margins are likely to increase.

Here I leave the original Thesis in VIC (user ChapterTwelveCapital): https://valueinvestorsclub.com/idea/AVANTE_LOGIXX_INC/2677184828

The main part of this thesis that makes the company so attractive is that it should start generating $2-$3M EBITDA annually, with an EV of $8M we are left with a EV/EBITDA of 2.5-4. Absurdly cheap for a quality business like this.

This is the theory.

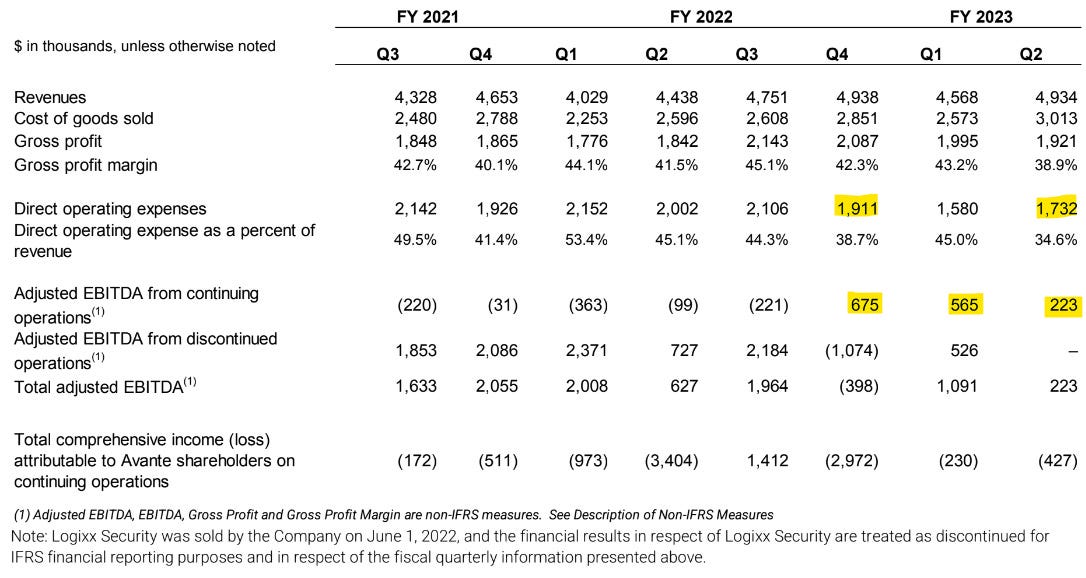

And if we look at the last quarters, things don't look too bad.

In Q4 '21 and Q1 '22 we already saw adjusted EBITDA of about $600K per quarter, $2.4M annualized. Good.

Not so fast.

What I Don't Like

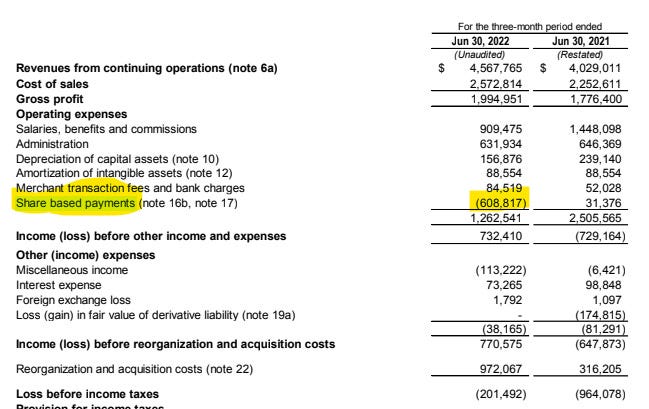

In Q4 '21 we have an adjustment related to the sale of Logixx Security.

In Q1 we have a positive adjustment due to options on the company that the previous management had, and that have been canceled with the sale.

In Q2 of '22, where we no longer have adjustments, Adjusted EBITDA is only $223K. This calls my attention, because compared to Q4 '21, in this quarter we have had similar revenues, similar gross profit and lower operating expenses. Overly optimistic adjustments may have been made in Q4.

And such adjustments are not new to the company, which seems to have some track record of paying its CEOs well, both with stock packages and severance pay. In '17 $450K was spent on a stock package for the CEO, after $582K was spent the year before to let go the previous CEO. In '22 $968K was spent in reorganization expenses, including CEO severance at the time.

An important part of the benefits of recent years have gone to organizational adjustments.

With last quarter's margins, Avante is on track to achieve $1M EBITDA annualized, far from the $2M - $3M that would make this investment so attractive. However, there are a couple of things that I think can happen that will bring us closer to this number.

What I do like

Let's go with the good:

Avante Security has achieved EBITDA margins of around 10% in the past, before the acquisitions made within the Logixx segment and when the business was similar to the current one. They have also achieved them with less scale, so they should be able to increase prices and control costs until they achieve at least as much. With this we would already be at about $2M of EBITDA.

The current CEO is aligned. Emmanuel is the founder, and has refused to sell his shares at double the current price. These shares are the majority of your equity and the stock options you hold are above the current price. He has every incentive to increase profits and use company cash well.

The company has very little scale after the sale of one of its segments, and much of the spending is corporate.

These expenses most likely will not scale if the company makes an acquisition and scales revenues, which should further increase margins. An acquisition within the luxury security sector is, in my opinion, the most important catalyst for this investment.

Conclusion

Avante Logixx does not appear to have achieved the expected cost reduction so far, possibly due to wage inflation. However, if the business is of as high a quality as it seems, we should see price increases in the coming quarters until returning to EBITDA margins in the 10% range. In that case we could buy the company at 4x EV/EBITDA. If they make any acquisitions with the cash they have they could increase scale and margins, so we'll buy the business for even less.

What am I going to do

The catalysts are clear, and the risk is that the current CEO will not be able to turn around the profitability of the company and make acquisitions that create value. A nano cap this size, with hardly any analysts, should give us at least 1-2 quarters of good results before the share price reacts significantly. I am going to wait, if Avante manages to continue improving its EBITDA margin (without unusual adjustments), it is very possible to buy.

Come on, see you in 3 months.

In Portfolio: Makolab. They hire wisely, raise prices.

In a year in which many of the world's largest technology companies have gone from record hires to thousands of layoffs, as the 11,000 META or the Amazon's 10,000 there is a Polish company that I studied last year that is going smoothly, doing what they announced they were going to do. Makolab

Original Makolab analysis here, from November 2021:

Since last year Makolab has added 7 employees to its workforce, 4%, not impressive. What is more interesting is to see that with this increase in employees it has managed to increase sales by 28% to PLN 51m and EBITDA by 42%, reaching PLN 4.7m in the first 9 months of '21.

Price rise

Makolab continues to be affected by wage inflation in Poland, which in the IT sector is even more serious than general inflation. The wage cost per worker has increased by 21%. The board has focused on doing what it said it would do last year, raise prices. Income per worker has increased by 23%.

I suspect that strong wage inflation is the reason the company has hired so few people during this period. It's hard to increase margins, with costs growing so fast and new hires. The company seems to have pricing power, but there is a certain delay between when a contract is signed at an agreed price and when it is executed, so these increases are not immediate.

From what the directive tells us, there is still no demand problem and they are limited by the supply of IT professionals. I expect this situation to improve in the coming years as inflation comes down and they can continue to grow staff at a double-digit rate.

Margins increase

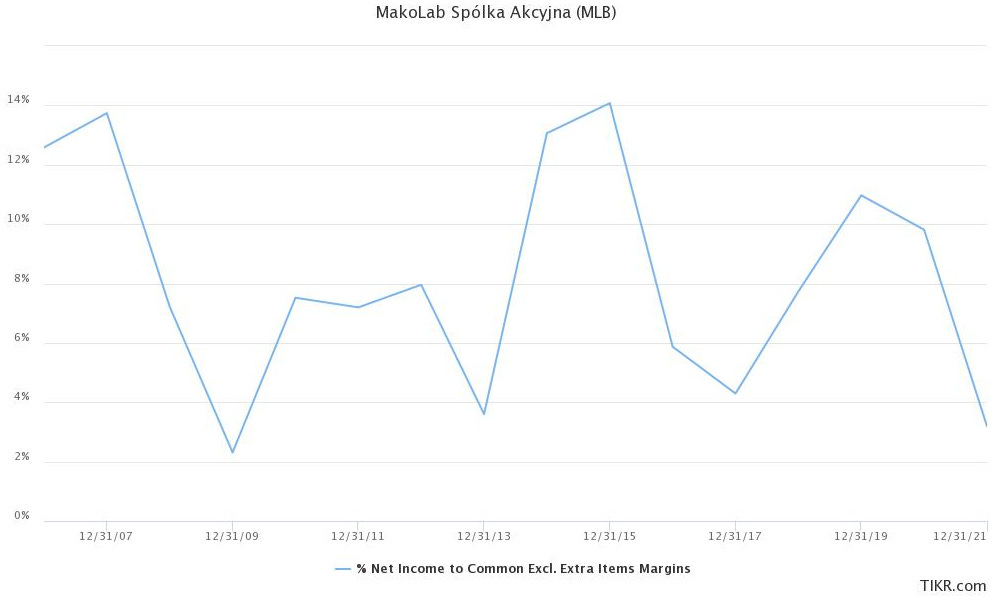

Software engineering companies have EBITDA margins of 12%-15%, which leaves a net margin of 9%-11%. Makolab has had a rather volatile track record, which is to be expected from such a small company. But the historical average does not stray from this range. The main part of the investment thesis at Makolab is that the company has enough demand and pricing power to recoup at least an 8% net margin, up from the 3% they achieved in '21. Wage inflation cannot go on forever.

And that's what seems to be happening, EBITDA in the first 9 months of '22 has been PLN 4.7M, 9.2% vs. 8.2% last year. It's not a full recovery, but it's a good performance taking inflation into account.

Other developments

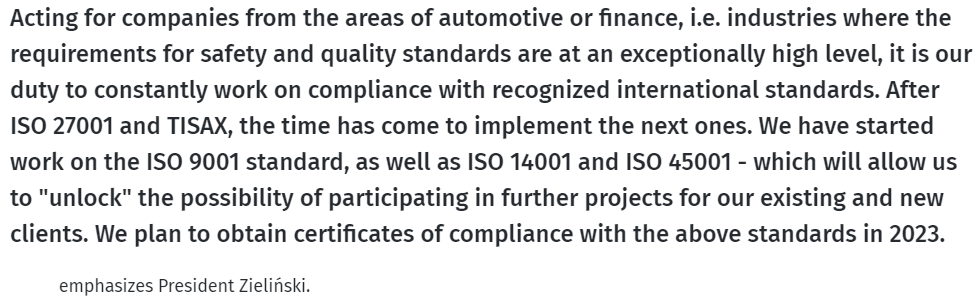

Makolab expands certifications and seeks ISO 9001, 14001 and 45001, safety and quality regulations required by many organizations to participate in projects.

On the other hand, the company continues to develop its project based on the blockchain Graphchain and Makolab USA has had PLN 1.2M in sales these nine months, double that of last year.

Conclusion

Everything is working as expected, although a bit slow. Makolab finds it a little difficult to grow in an environment of so much salary inflation and also to improve margins. However, it is managing to do both moderately.

What am I going to do

Makolab is still absurdly cheap. I keep my position, which is 10% of my portfolio. At the moment I am not selling anything to buy more, I dare not because I perceive that the company has a risk of customer concentration, if they eliminated this risk in the future, I would probably buy a higher percentage.

Thanks for your update - it is worht reading as usual. I have been looking around the Polish software sector for some time but am still on the sidelines - but MLB looks compelling.

Have you looked at other Polish software firms and compared (e.g. Spyro-Soft, Livechat)? They are bigger but still have some runway, also more expensive on a multiples but still reasonably priced given they are growing. The sector overall looks quite interesting.