Good morning Micro Investors!

Welcome to Micro Caps in 10 minutes. If you are not yet subscribed, you can join the best newsletter for independent investors who are not afraid to invest in the most unknown companies on the market. If you are a colonizer of the universe of micro caps, this is your place.

In this new section, which I will publish every 2nd Friday, we will be able to review portfolio company updates, news and investment (or non-investment) ideas. With this I will try to publish content more consistently without limiting the newsletter only to long analysis of companies.

And with this, to the point. Today in 10 minutes:

1 - Idea: Allcore, tax solutions for small businesses in Italy.

2 - In portfolio: Sescom, the recurring business of repairing things.

Idea: Allcore, tax solutions for small businesses in Italy.

Spoiler alert: I have NOT invested in Allcore, read on.

Allcore (BMI:CORE) is a company that offers tax and accounting services to small and medium-sized companies in Italy. To a lesser extent, it also offers credit intermediation and networking services for entrepreneurs. Its added value is that it industrializes tax management, offering businesses that usually use small agency services a better quality service at a lower cost. For this, they use software that reduces the hours dedicated to repetitive management tasks and they have better professionals and protocols due to their scale.

Founded by Gianluca Massini, the company has had a 50% annual growth in its sales since its foundation in 2016. Growth partly thanks to the fame of its founder, who is also the author of several books on tax optimization, partly thanks to digital marketing strategy and partnership with other companies in the sector.

It trades at 3.5x EV/EBITDA, without debt, ROCE of >30% and almost zero CAPEX needs. Too cheap. Allcore should trade at 7x EBITDA as larger peers assuming no growth, or 10x EBITDA assuming moderate growth.

It is a quality business with a series of benefits.

Recurring income. Once a client delegates the tax management to a company, there is a change cost when changing, the cost of this management is small for the clients. These two factors mean that the churn rate is 10%, with the objective of the directive to take it to 5%.

In Italy there are 1M small and medium-sized companies, spread over about 100,000 registered tax advisors. It is a fragmented market where agencies with 5-10 workers cannot offer specialized solutions.

Organic growth. The company has grown to 30%-50% without making acquisitions. This growth has come from spending on digital advertising (Google Ads, Facebook...) and associations with small agencies to increase geographic reach.

On the other hand, business is not risk-free.

Dependence on its founder.

Gianluca Massini created the “Soluzione Tasse”, which he owned until 2021, until he sold it to the company for €500K. Part of the company's growth and perhaps the ability to acquire customers cheaply could be attributed to the fame of its founder. This risk can materialize in difficulty in scaling the business once it no longer depends on the image of its founder and in excessive remuneration that harms the benefits of the rest of the shareholders.

Gianluca also owns 60% of the company so he has a lot of freedom to pay himself as he sees fit. In 2021, he received €750K for management (in addition to the €500K from the sale of image rights) and in 2022 he has an approved remuneration of close to €650K. This when the company has generated €2M of EBITDA.

In addition to this, they have established a management compensation plan that links it to EBITDA, being able to reach 20% of EBITDA if targets yet to be determined are reached. Compensation is mostly cash and short term, I would like to see less cash bonuses (particularly to the founder) and more shares. It also contemplates remuneration to company executives who are still not clear who they are. For example, Mr. Gianluca holds the position of Chairman of the Shareholders' Meeting and CEO. He could potentially collect bonuses and shares for the two positions, with a total remuneration close to €1M.

Without a doubt, this section must be monitored in the following exercises.

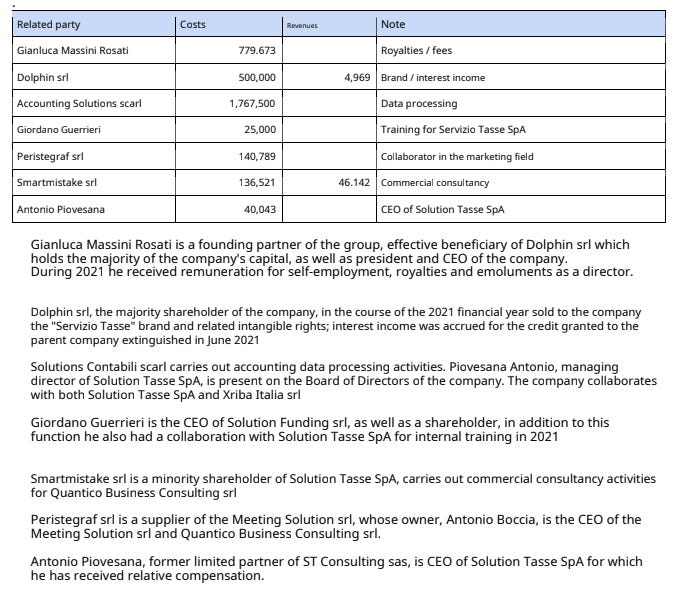

In addition to the high remuneration for directors, we have a good list of transactions with entities related to the company:

Possibly they are within the normality of the business, but we must pay attention to the fact that the CEO of the company is a member of the board of directors of a supplier that invoices €1.8M to Allcore.

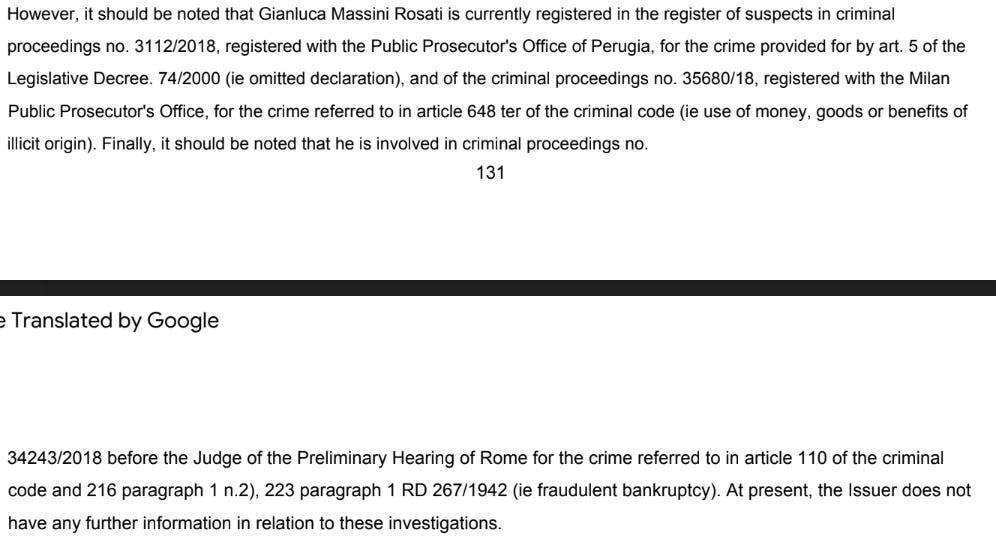

And finally, the icing on the cake for me. Gianluca Massini is currently suspected of several crimes, which the company itself indicates in its IPO documents.

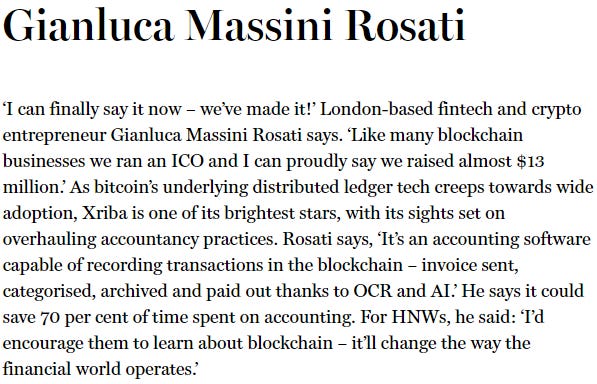

Bet on cryptocurrencies.

In 2022 the company has dedicated 9% of its treasury, €1M to the purchase of stable coins. This is part of the commitment to become a reference in tax management, so it is an opportunity, however, stronger bets in this line may carry risks.

The founder is very "bullish" with the cryptocurrency sector. Something without a doubt with potential, but that must be monitored, especially if you dedicate the treasury to buying cryptos.

Conclusion

Soluzione Tasse / Allcore is a light on capital, growing business in a non-growing but segmented sector, creating an opportunity to gain market share with a roll up. The valuation should be 3x the current one. However, I see several clear risks related to the complex capital structure and management compensation (both directly and through transactions with related companies). None of the elements that I have mentioned in the previous point is a red flag by itself, but all of them make me doubt.

What I am going to do.

For the time being, I'll leave it on follow-up, I want to see:

Objectives established both in the short and long term by the board.

Total remuneration of the board.

Evolution of transactions with companies related to the directive.

Capital allocation of the €11M they have in cash (30% of the capitalization).

I will not invest. We will see each other in 6 months, with the annual results for 2022.

In portfolio: Sescom, the recurring business of repairing things.

Sescom (WSE:SES) has finished its fiscal year in September with sales of PLN 160M compared to PLN 134M in 2021. A growth of 19% that becomes less impressive when we review the inflation data in Poland. In real terms it has barely grown.

Here is the analysis of this installation maintenance company in commercial premises, which I have had in my portfolio for a year (I made it in spanish but works pretty well with google translate):

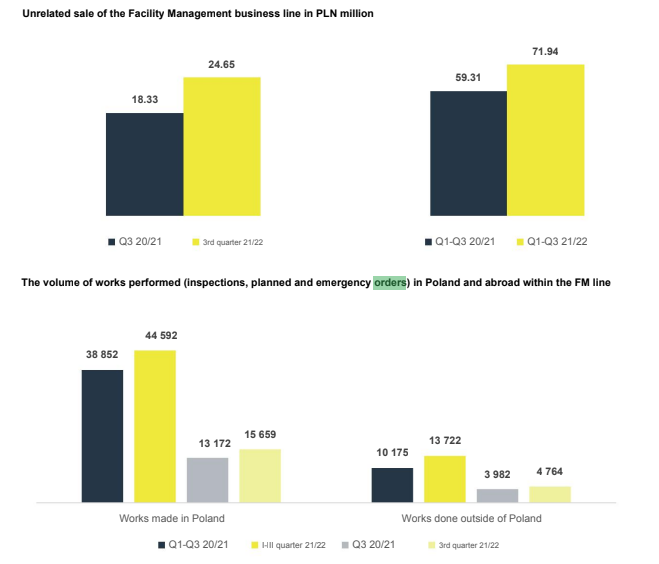

Sescom at first glance seems to have managed to raise prices with inflation, which is a good indicator. But has it?. In the absence of knowing the results of the full fiscal year, we can only see those already published in Q3 (until June 2022).

The main business does not look bad, in this period the growth in sales of the facility management sector was 21% and the growth in the number of jobs executed was 19%. Good with the price hike.

The core business EBIT margin has grown from 4.8% in FY2021 to 5% in the first 9 months of FY2022. I expect Sescom to end FY2022 with an EBIT of PLN 8M in its core business.

Camouflaged result

This result will be camouflaged by losses of about 6M PLN in its other two lines of business under development.

One of them is FIXFM, the application to connect repairers with customers. They have already discontinued this line due to the difficulty in finding external financing, things are not going to get off the ground this year, it must be difficult to finance apps that lose money.

The other line is the development of heating systems based on hydrogen. Here they will continue to spend about 2.5M PLN per year. The results of this R&D work remain to be seen, but the company hopes to be able to obtain European funding and it is very much in line with CO2 reduction trends.

No acquisitions but new contracts

The company has stated its intention to buy a competitor in a foreign market, to boost growth outside of Poland. At the beginning of the year it seemed that they were going to execute the first one, by buying a company from the United Kingdom, but they have backed down. The directive maintains its intention.

Although they do not grow through acquisitions, they do have new contracts that generate organic growth, such as JD Sports or North Fish, the latter in London (outside of Poland, I like it).

Conclusion

Sescom is passing costs on to its clients, perhaps with some delay, but it is passing them on. It does not lose clients and grows somewhat above inflation in a difficult year. Main business does not seem at all affected by inflation. It should be able to get back to its historical 7%-8% EBIT margins while still growing organically.

What am I going to do

Maintain the position. It is a business that is proving to be resilient, if we have a recession it will remain stable. Recurring income and light on capital, P/E 7.5, too cheap.

In the next publication of Micro Caps in 10 minutes…

-Investment idea nº1: Canadian company.

EV/EBITDA 4

Buying back shares and growing.

Managed by its founder.

-Investment idea nº2: Norwegian company.

EV/EBITDA 2

Repurchasing 10% of its shares.

Sector with tailwinds.

If you liked this publication of Micro Caps in 10 minutes, do not forget to subscribe to the newsletter. Join the community to receive news and analysis about illiquid, unknown and high potential micro caps.